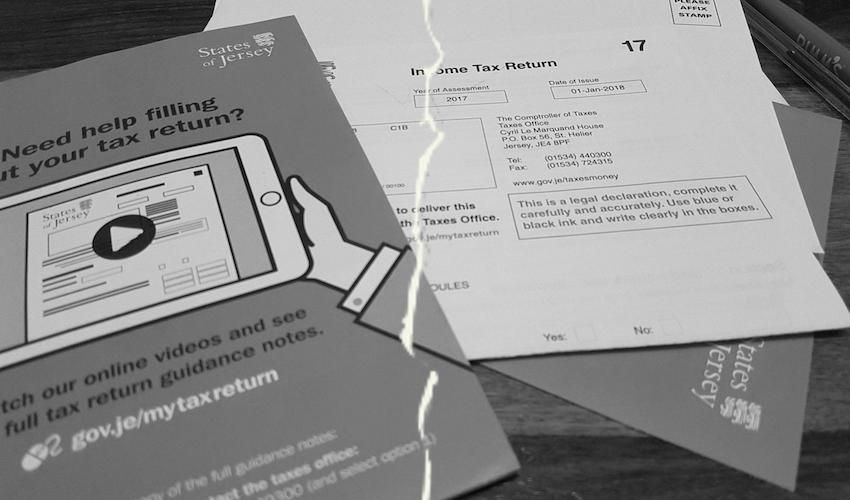

More than £4million extra could have been taken in taxes if the Comptroller had used his powers to ensure islanders pay what they owe more frequently, the Treasury Minister has said.

Deputy Susie Pinel said she was concerned over how infrequently the Comptroller for Taxes has used “production powers” to force taxpayers to provide documents when they have refused to do so - powers that she is planning to increase as part of the second stage of a programme aimed at transforming the tax system.

Under the current law, the Comptroller has production powers that allow him to require a taxpayer to produce documents when they have previously refused to do so on request. They are generally used against individuals and businesses as a “last resort” before bringing the matter before the judiciary.

In her reply to the Corporate Services Scrutiny Panel’s report on the Draft Revenue Administration Law, the Treasury Minister suggested these powers could have been used more frequently.

Pictured: The Treasury Minister, Deputy Susie Pinel.

She said the Comptroller has used all of the production powers available to him only nine times in the last four years, adding that she was surprised the Panel in charge of scrutinising her tax law changes did not share her concerns over that infrequency.

She said that together the use of all the production powers involve potential additional revenues of over £4 million in tax (excluding any penalties). In the 2018 Annual Report and Accounts, released today, Deputy Pinel also said that £8million of the £635million of tax income had come from “tax compliance activity".

Deputy Pinel explained the powers will be reviewed for the next step of the revenue transformation programme to make more of them subject to civil penalties for default.

The Scrutiny Report highlighted that both Grant Thornton and EY had raised concerns over the proposed changes, saying they would give rise to “fishing operations”, with no right for the taxpayer to appeal.

Pictured: The Comptroller for Taxes, Richard Summersgill.

EY’s Head of Tax told the panel that they had no issue with the Comptroller being able to force taxpayers to provide information when it is due or to pay the tax when it is due.

They added: “What I had hoped to see is not just an increase in power to the comptroller but the ability for a taxpayer to challenge or to appeal against either a demand or an assessment or an inquiry if they thought it was inappropriate and that is just not there.”

They also disagreed with the view that production powers are used as a last resort saying they had real examples of when they had been used as “a tool of first resort”.

The Minister said these represented “a minority view from a small number of tax agents” adding that the Chartered Institute of Taxation – who represent many of the Island’s agents – had not voiced similar concerns.

She expressed disappointment at the fact the Panel had not been able to take evidence from a wider section of stakeholders in the tax system, and that it had given “quite so much weight to the views” of just one or two tax agents, rather than the views of the agents’ principal professional body.

Pictured: The Treasury Minister says it is "essential" for the Comptroller to be able to force taxpayers to provide documents and information. (States Assembly/Scrutiny)

Deputy Pinel said it was “essential” for the Comptroller to have sufficient powers to force the production of records and information, where taxpayers refuse to co-operate with an enquiry, without a reasonable excuse not to do so. “Everyone must pay their fair share of taxes,” she said.

She also noted that the existing powers can be appealed by way of Judicial Review. If the Assembly agrees to the creation of new production powers - with civil penalties rather than criminal sanctions - the penalty itself would be appealed before the Commissioners of Appeal, which Deputy Pinel says will be less cumbersome for taxpayers, as well as Revenue Jersey.

The Minister explained that tax administrations generally avoid “fishing expeditions”, but reserve their right to conduct “random compliance enquiries".

Pictured: The States will debate the proposed changes later this year. (States Assembly/Scrutiny)

“The basic fact of the matter is that tax enquiries can be opened for purely compliance purposes – to establish that individuals and businesses have correctly returned their income, and this is an important check on the tax system,” she continued.

“But the vast majority of tax compliance checks are not random: they explore perceived or proven risks of tax leakage and/or available intelligence; and the reality is that the Comptroller simply does not open speculative tax enquiries”

The Revenue Administration Law, which forms the first part of the revenue transformation programme, will be debated in May. The Minister expects to bring the second tranche before the States Assembly alongside the Government Plan later on this year.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.