If 2019 was a year that tax officials in Jersey will probably want to forget, then they will be hoping today's announcement that islanders can finally complete their returns online marks the beginning of the fightback.

Paper forms for your 2019 personal tax return will be landing on doorsteps across the island any time now, but, for the first time this year, they will also include details on how to complete a digital return instead.

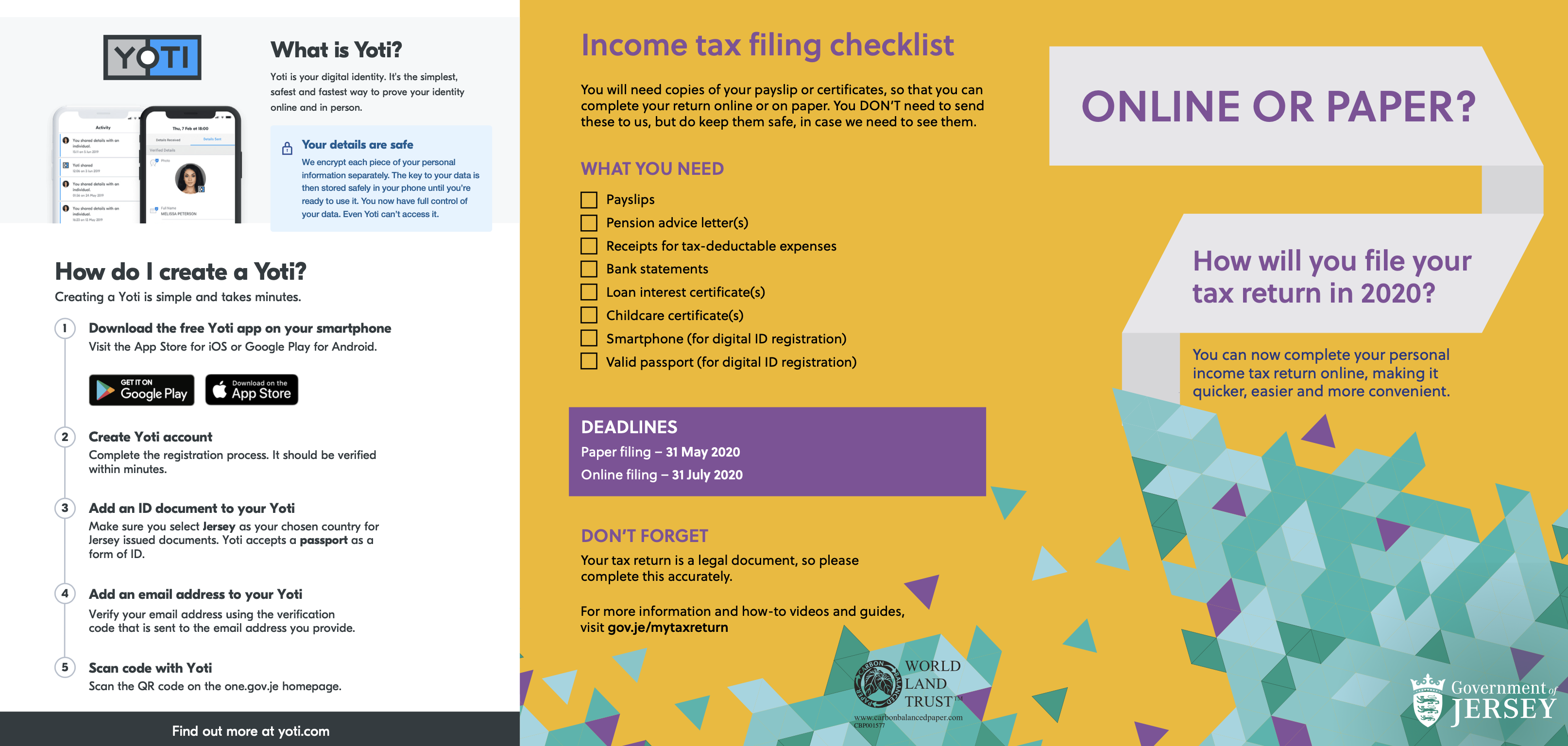

Revenue Jersey says that filling the necessary details in online will be more convenient, quicker and easier than using the paper form - for example, answers given will automatically eliminate subsequent sections of the form that do not apply, removing the need to work out which sections need completing.

The form can also be saved for completing later on, and you'll get an automated receipt as soon as it's submitted.

The government has also allowed an extra couple of months for those who want to go digital: the online deadline is 31 July 2020, while the paper deadline is 31 May 2020.

Filing an online return will involve using the government's new system for creating a digital ID, provided by Yoti, which will confirm the identity of the islander submitting the documents.

Pictured: Filing an online tax return involves creating a digital ID with Yoti.

Last year, it emerged that tardy tax filers could raise around £1.3m in fines, as those responsible for the 5,400 returns which missed the deadline at the end of May faced penalties of up to £250 each.

It was a slight reduction on 2018, which saw more than 6,000 late filers raising a total of £1.5m in fines for the Taxes Office.

Tax Comptroller Richard Summersgill said that while many customers left their tax returns to the last minute, he expects to see islanders’ behaviour change when online filing is introduced.

The changes follows a very difficult year for Revenue Jersey, with the move to a new IT system leading to long delays in processing islanders returns, and some suggesting mistakes in the amount due, had been made. This morning, Treasury Minister, Deputy Susie Pinel added her apology to those given at the end of last week by her team.

“We recognise that while launching this service, we are still dealing with a significant backlog of 2018 tax return assessments, for which we continue to apologise. However, we believe that launching this service now is the right thing to do. In fact, it will benefit our teams, as any forms completed online will reduce inputting and assessment time by our staff to process the return, meaning they can get through 2019 returns far more quickly.”

Pictured, Comptroller of Revenue, Richard Summersgill, hopes online filing will help reduce the load on his team, and speed up the process.

On Friday, Richard Summersgill said that online filing would help to solve the problems faced in 2019 by his team: "I sincerely apologise for the delays in completing the 2018 assessments, and for the poor level of service we have been providing to Islanders, which has led to longer waiting times to speak to an adviser, both in person and on the phone.

"Staffing levels and the implementation of the new system have had knock-on effects on our service, but we are doing everything we can to complete the 2018 assessments and get service levels back up to the standards that Islanders expect.

"The launch of online filing later this month will significantly reduce the number of manual assessments we need to do, which will also help to improve services. I urge people to file online this year if they can.

The government says that a series of free drop-in workshops will be available for people to learn how to complete the online process, and "full information" and guides on how to set up a onegov account and a digital ID, using YOTI, to fill out the online tax form, is available online.

Video: How Yoti works. (YouTube/Yoti)

Online filing is part of a major program to modernise the tax system, which will also see a crackdown on islanders avoiding paying enough tax.

Under a proposal entitled 'Spend to Raise,' Revenue Jersey (formerly the Taxes Office) sets out plans to spend £1,562,000 a year for each of the four years from 2020 through to 2023, to cut down on the number of islanders not following the tax rules.

In total over the four years, it's claimed the crackdown will generate an extra £40million.

It'll mean an extra 21 full-time staff in Revenue Jersey, "...which will drive improved compliance in the tax system and deliver additional revenues. Without such investment, it is likely that tax compliance in Jersey will continue to deteriorate."

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.