Taxes will have to go up to avoid a "massive black hole" in public finances arising from Jersey's response to the health crisis, the Treasury Minister has warned, stating that future generations shouldn't be left to "pick up the pieces."

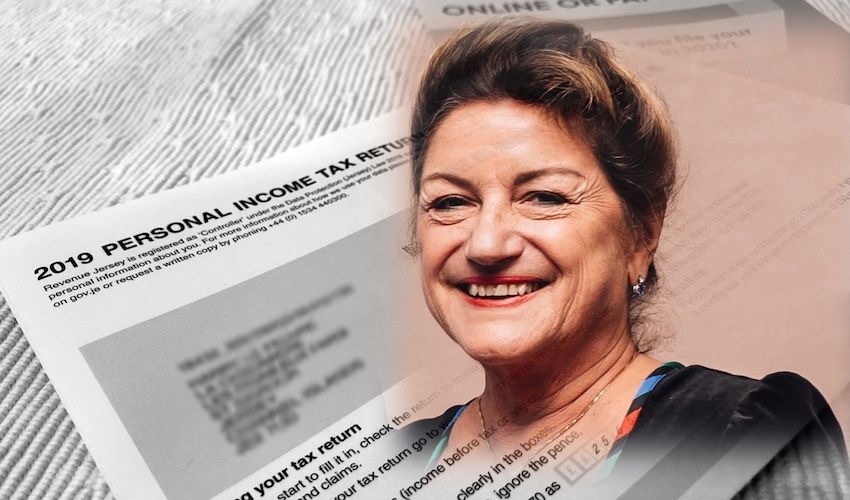

Announcing the likely rise yesterday, Deputy Susie Pinel added that any increases would be done in a balanced way, with everyone paying their dues fairly.

She added that there would be a review "across the board" ahead of any changes being made, saying that she wouldn't allow the gap between the island's richest and poorest to widen as a result.

Despite reassurances, the Treasury Minister's comments, which echoed an earlier warning that "there is no such thing as free money" from her Assistant Minister, Senator Ian Gorst, has set the Treasury team on a collision course with former Chief Minister Frank Walker.

He said the government should be looking at replenishing any money used during the crisis over the long-term instead.

Pictured: Deputy Pinel said the review would ensure the local tax system remains "stable and sustainable".

Deputy Pinel's remarks came during yesterday's virtual States Assembly meeting, following a question from Deputy Inna Gardiner, who sought assurances that Jersey’s tax system would be reviewed, including the ‘zero-ten’ regime and GST.

The Treasury Minister replied that it was likely she would have to raise taxes in the aftermath of the covid-19 pandemic to “help restore government finances”.

“Such an increase will need to be balanced against the needs to stimulate the economy and requires careful consideration to ensure our overall tax regime maintains the international competitiveness of our economy, remains stable and sustainable is fair and equitable and continues to enable us to deliver vital services for islanders,” she explained.

The Minister then went on to say that she will be reviewing options for raising taxes with other Ministers, in accordance with the tax policy principles set out in the latest Government plan.

Pictured: A “very, very broad range of people” would be consulted during the review, the Minister has promised.

Deputy Pinel also said she had asked officers from the tax department to accelerate work on the ongoing review of personal tax – including considerations for the removal of ‘prior year basis’ for taxation – as well as on the planned review of the international services entities scheme, which forms part of Jersey’s GST regime.

She gave reassurances that the review will be “across the board” and will not concentrate on just one area, promising that her department was “very aware” middle earners should not carry the burden.

She went on to say that a “very, very broad range of people” would be consulted during the review, including representatives from “all departments, angles, taxpayers and non-taxpayers”.

Deputy Pinel said she would do what she can to ensure “any changes to the tax system only supports reducing income inequality”, as suggested by Deputy Montfort Tadier.

Pictured: "We can’t drain resources and leave it for future generations to pick up the pieces," Deputy Pinel said.

“Equally, the population has to be aware that there is a huge demand on our resources at present and that will have to be replaced,” she however added.

“We can’t drain resources and leave it for future generations to pick up the pieces.

“It’s going to have to be a very, very careful review as to what we can do that doesn’t harm those who can least afford it, but equally will build the coffers for want of a better word, that will have not necessarily drained but certainly used considerably during this crisis.”

“The funds will be replaced and there mustn’t be an additional burden on any sector of society,” she later added.

“We are all in this together, as the phrase currently goes. It will be across the board; we will have to make sure everyone pays their dues and pays them fairly.”

Pictured: "We will have to make sure everyone pays their dues and pays them fairly," Deputy Pinel said.

Deputy Kirsten Morel challenged the Minister’s announcement, saying it would create greater uncertainty at a time when islanders are seeking assurances as people are losing their jobs and businesses are collapsing

The Minister however defended her position, explaining that she had been consistently asked how she would repair the “financial damage that this pandemic is causing."

“It would be wrong of me not to answer and I don’t think it’s causing panic... It is just to reassure islanders that we are going to have to review this and to be transparent now to warn people that this is what we are going to have to review, and taxes of some sort of description, we don’t know which yet, will have to increase in order we don’t have a massive black hole.”

Following the debate, Jersey's first Chief Minister Frank Walker took to Twitter to share his views on the Minister's comments.

Pictured: Deputy Pinel said she disagreed that discussing tax rises would cause panic, and that it was more important to be transparent.

Warning about talk of raising taxes, he urged for depleted funds to be replenished over the longer, rather than the shorter, term.

"The Rainy Day Fund took decades to get to its current level and there is no way we should be looking at replenishing it in the short term," he wrote.

"We need to develop a joined-up plan to use it sensibly in support of the economy and build it up again over the next few decades."

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.