No sooner than Ministers have agreed support measures for an economy hit hard by the pandemic, it seems they are thinking of ways to get the money back.

There is broad agreement that we are all going to have pay more, but when that might start seems much more of a debate. Why replenish the Rainy Day Fund when the economy is struggling?

With Jersey's plans for easing lockdown due to be revealed this week, Express has been running a series of articles on what should be in it. Today, the Director of accountancy firm Purpose, Luke Smith, challenges some of the common statements coming out of Ministerial mouths...

"When it comes to rebuilding public finances, think financial patience not pain.

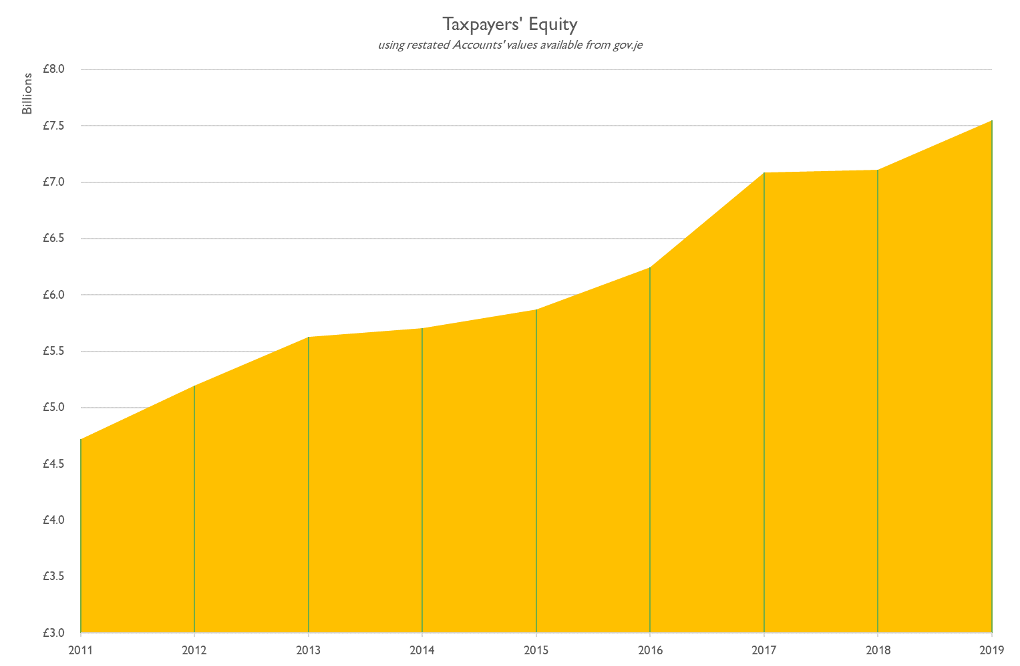

Our government’s accounts show taxpayers’ equity rose to £7.5bn by the end of 2019, and that more than £2.5bn of that value was created in the last eight years. This £2.5bn, at least, is therefore not other generations’ money. It is ours. Taxpayers’ equity is our equity.

Pictured: At least £2.5bn has been generated in the last eight years.

Taxpayers’ equity is all our assets less all our liabilities as an Island: effectively what we own, all our reserves; the reserves we have generated from paying tax and investing, less the public services we have paid for.

Since 2013, all involved have done a great job increasing our equity, and I now understand those involved in the decision to change investment strategy have catapulted our equity to where it is now. So, thank you and well done everyone involved.

When our current Ministers say we are in a strong position, they are not kidding.

In 2019, whilst we spent £1.3bn in revenue expenditure, with the £7.5bn in net assets we have, we could, theoretically at least, continue to spend at current levels with no income for five years and nine months before really being in debt.

Pictured: Graph showing taxpayers' equity using gov.je data.

If we owned shares in the government, we would rightly be knocking on doors to ask for a dividend.

Now we have got to almost six years of cover for our expenses – arguably the biggest question for the Fiscal Policy Panel to answer is how many years’ surplus taxpayers’ equity is enough?

That said, it is our money, and local, appropriately qualified people should have input into policies for which there is no right or wrong answer; only a feeling of tolerance to risk.

Given the fact we are unlikely to receive a dividend(!) and we do have all those surplus assets, a call for patience and not pain is warranted.

I say this, despite the fact investment returns and values may fall, as will ITIS and GST collections. Six years of cover, with no income feels like a lot. We can afford to do the right things to stimulate the economy and accept a couple of years where taxpayers equity might dip from its year-on-year high. That’s what businesses are being asked to accept and what the government must accept too.

Pictured: Luke Smith argues for patience not pain in Jersey's recovery plan.

Recently there have been three consistent themes that I feel must be challenged:

1. “These assets have built up over generations”

Well, obviously they have, but the speed of their growth is important. At least £2.5bn is from the last seven or eight years. The Cambridge dictionary defines a generation as “a period of about 25 to 30 years, in which most human babies become adults and have their own children.” The two or three current working generations have contributed significantly to the last few years of growth, and deserve a break before retirement or building up their savings again for the future. Some of the excellent pension schemes of the past are also being paid for now by us, and so patience is warranted.

2. “We mustn’t leave a debt for the next generation”

OK, I agree the principle, but please be clear. Are you saying:

a) “We mustn’t owe anybody any money”; or

b) “Our balance sheet must not owe more than we have”; or

c) “Our generation must create a surplus for the next one"?

If a) – This is far from practical and probably not desired. Borrowing some money to fund investment is a good idea if the interest cost is lower than the return from the assets we keep. Even if no debt is the objective, we don’t need to borrow in the medium term, if we sell some of our poorer yielding assets to avoid borrowing.

If b) – Ignoring the collapse of western civilisation, this is not at risk. We would have to lose billions in assets with no income.

As our local businesses will testify right now, control of costs when you can’t be sure of revenue is more important than anything else, and just because you can tax people more, doesn’t mean it’s in our interests to do so. We’re going through a hugely painful blip, and no doubt there are more to follow, but control of costs will see us through in the medium term.

If c) – It is almost inconceivable we will lose all of the growth of the last seven or eight years in the next two, and that further growth will not return. Throughout all the crises, we have over time, grown our assets.

If you are saying we must create a surplus every year then I go back to my question for the FPP and the Council of Ministers. When is enough surplus, enough surplus? Costs do rise year-on-year, but as costs rise, so often too do GST and current tax revenues. Pointless talk of black holes in the short-term must be avoided, and each public service cost weighed up against its value.

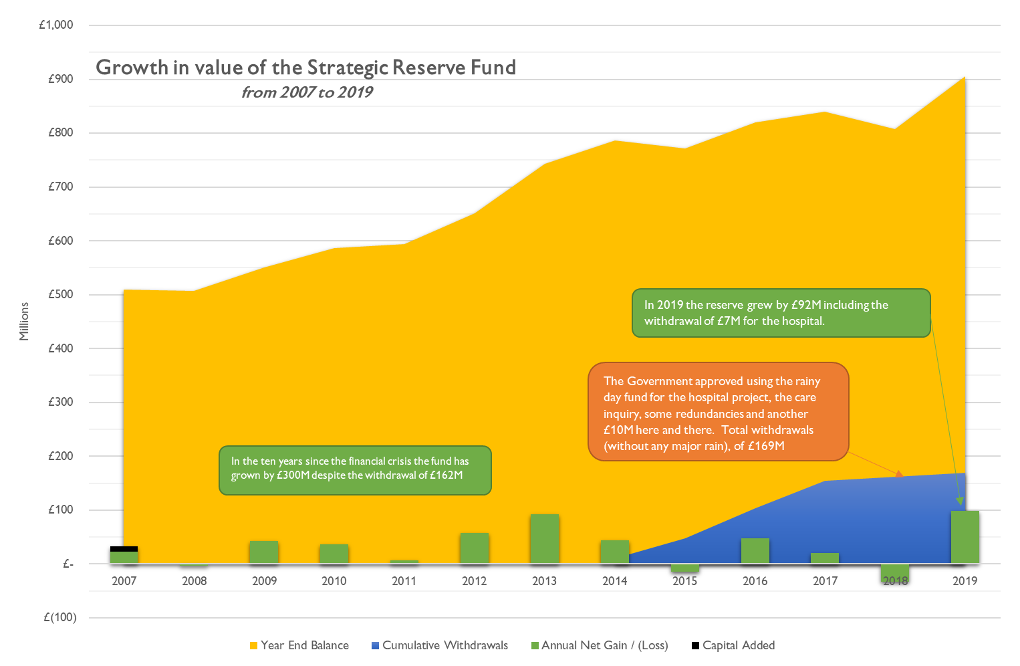

3. “We must restore the rainy-day fund”

Replenishing the Strategic Reserve Fund is just an accounting entry, and some investment portfolio transfer documentation, following a vote by the right people.

We have £7.5bn of reserves. Transferring them around is easy with political will to do so, especially when at least £2bn of those reserves were generated over the last five or six years. Any other argument here is floored, especially when ministers have already spent £169m of it for care inquiries, hospital consultations, redundancy programmes and other bits and pieces.

Pictured: The growth in value of the Strategic Reserve Fund from 2007 to 2019.

The financial and economic departments of the government seem to be doing their best under huge pressure and public scrutiny, but on recent video Q&As they have, understandably, seemed exhausted and in need of some time off.

With that unlikely in the short-term, I would just say that they caution themselves to step back, look at the bigger picture and give themselves time to do so.

I sometimes criticise my team at work for coming up with problems not solutions, and I have done little here other than to say be patient, control costs and don’t use bad political arguments as an excuse to increase taxes when we don’t yet need to.

Confidence is key and we have the money to restore confidence, get the economy moving quickly and get people back to work and earning taxes."

Eliot Lincoln: Time for government to help businesses get paid

David Warr: View from the business frontline - Cooper & Co