This is a question that most trustees will have been asked by their private clients and to date would have been unable to provide a simple response.

Traditional mortgage providers focus purely on lending within their home jurisdictions. This clearly makes sense for their business model and provides

an invaluable service to the mass public. However, what do you do if you live overseas and wish to buy a property in another country? Historically, there was

no immediate solution that came to mind.

International residential lending is an area that is both difficult and time consuming to arrange. However, I am delighted to advise that Tenn Capital has created a unique lending solution that can solve this challenge for an international based borrower to ascertain financing for a residential property outside of their home jurisdiction.

So, who are Tenn Capital?

Tenn was established in Guernsey in 2021 and has quickly proven itself to be a dynamic firm which has provided financing in excess of £100m on

residential property. It recently acquired Oaklands Secure Lending, a Jersey-based lending firm, and can now offer development and refurbishment

finance alongside its bridge and international residential loans.

What differentiates Tenn from its competitors?

For its international residential lending, Tenn has been able to structure such a unique lending solution with the assistance of funds advised by Elliot Advisors (UK) Limited, who provided an initial credit facility of £300m.

For internationally-based corporate service providers (CSP), Tenn can provide a solution to their clients who are seeking to buy a property outside of their home jurisdiction and also home currency!

Tenn has an experienced credit team which is complemented with outside legal advice to ensure that loans are streamlined in terms of efficiency and costs. Although anchored in residential property, Tenn will consider multiple assets that exist in private client portfolios.

Tenn’s USP is its ability to provide short-term finance to borrowers that are internationally-based and require access to finance as soon as possible. Tenn has a global lending remit and can use its prior experience to ensure speed and efficiency when reviewing lending proposals and solutions.

What types of lending does Tenn offer?

The following are the types of loans Tenn focuses on:

• acquiring a residential property;

• a developer seeking an exit;

• bridge to sale;

• equity release;

• development finance; and

• refurbishment finance.

Is there a limit on loan amount required?

Tenn does not have a limit as to what level it can lend to, but its sweet spot is in the £2m to £15m lending pool. It can also consider lending proposals in US$ and

euros. Tenn will consider loan to value (LTV) up to 75% but more importantly focusses on the quality of the borrower, residential asset and repayment strategy.

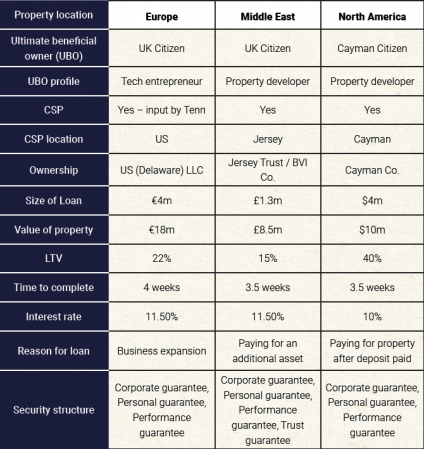

An example of some case studies for international residential loans are detailed below:

The team at Tenn are very keen to present their services to as many CSPs as possible and if you do wish to receive a presentation (which of course will be included as part of the participants CPD allowance), please don’t hesitate to contact us.

How to follow up?

Please email either Andy Whelan (andy.whelan@tenn.capital) or Steve O’Brien (steve.obrien@tenn.capital).