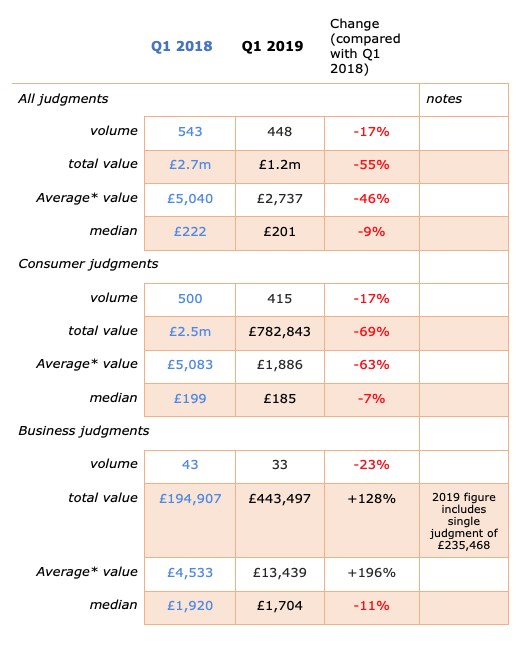

The average value of debt judgments against Jersey consumers and businesses dropped by nearly 50% in the first quarter of this year.

It fell 46% to £2,737, while the total number of judgments fell by 17% to 448.

The total value of all judgments fell 55% from £2.7million to £1.2million compared the same period in 2018, according to the latest figures released by the Registry Trust.

The total value of consumer judgments fell by 69% to £782,842, while the average value decreased to £1,886, 63% less than in 2018.

There were 33 business judgments, 10 fewer than in the 2018 first quarter. The median business judgment’s value to £1,704, while the average judgment value increased by 196% to £13,439.

Pictured: The figures for debt judgments in the first quarter.

Though there were fewer business judgments in the first quarter, there was a 128% percent increase in the total value to £443,497.

5.69% of local judgments were satisfied in the first quarter, compared to 10.52% in in England and Wales.

Mick McAteer, the Registry Trust's Deputy Chairman, said: “Registry Trust data is a useful indicator of the state of the economy, levels of unmanaged debt, and lender treatment of borrowers. Judgments against consumers in Jersey remain near record low levels at almost one-third the levels we saw in the midst of the great financial crisis in 2008.”

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.