Milton Friedman, the economist, said that the only social responsibility a corporate has is to increase profits within the rules of the game. In simple terms “the role of business is to be in business”. One cannot think of a more germane time than now to puncture that theory. The virus is, without doubt, a social pandemic with corporate viability squarely in its clutches. Corporates are facing their zero-hour moment.

One may argue that environmental, social and governance (ESG) factors finally found resonance of late, after years of being challenged by mainstream finance. Has the virus provided a temporary pause on ESG and corporate sustainability assessments?

The answer is a resounding ‘no’; in fact research suggests it has further amplified the concept. Corporates have had sustainability thrust upon them by an act wholly outside of their control. Their response, albeit by accident, may be a boon for some and value destructive for laggards. ESG forces a company to wrestle with issues that aren’t black and white.

The impact, timing, and the value that the market attaches to these risks are often not aptly appreciated, thus making ESG risk management the kingmaker. In 2020, we have witnessed leadership being summoned across government, corporate, public health service, and of course the average citizen in society to take action. We collectively grapple with the new normal. We tap into emotional quotient balances and sharpen tool kits so that we are able to respond respectfully.

Who is taking note of corporate responses in this time?

In crises, traditional fundamentals of valuation is trumped by the markets’ assessment of reputation, loyalty, engagement, relevance and citizenship.

|

People |

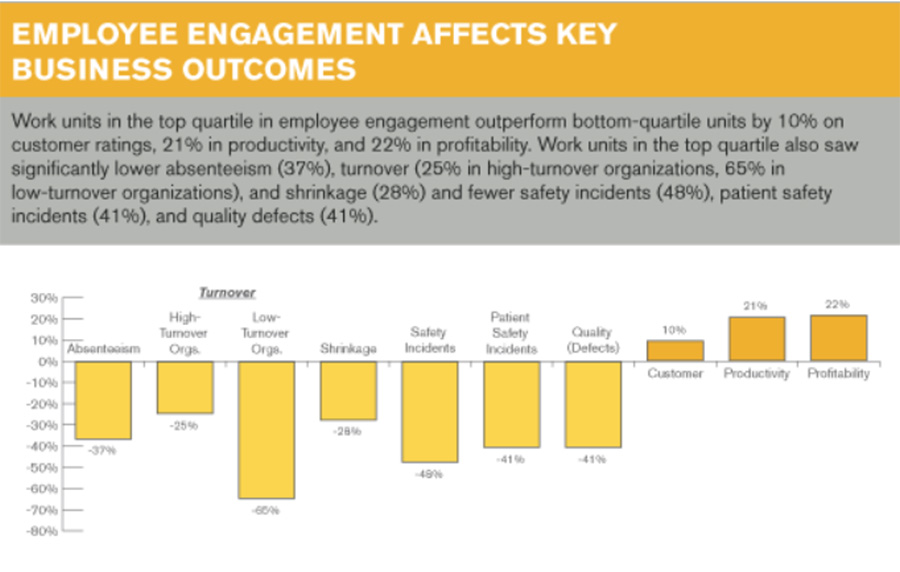

Employees measure up if employers are lethargic or proactive. Employee safety and well-being are important, for example equipping employees with safety kits and introducing flexibility in sick leave policies. Are they financially secure and is their job or salary at risk? Trust finds a niche connection between employer and employee. |

|

Customer |

Customers look toward corporates to deliver on goods and services. Financial services companies are seen as the lighthouse of economies. Customers weigh up whether investments are guarded and payments are made, not being left to irrational acts. Clear and effective communication is paramount. |

|

Supplier |

Suppliers are looking to stay afloat. They are balancing their business’ liquidity requirements. They need free cash float to withstand payment terms that might have to be deferred. They are seeking repayment flexibility from financiers. |

|

Investor |

Healthier balance sheets are enduring. Our discussions with asset management firms suggest that resilient companies have cash reserves; diversified revenue streams, off-shore or local earnings mix, and strong assets that can withstand devaluation. Companies with excessive debt are vulnerable with operating margins and cash flows facing a threat of decline. |

|

Rating agency |

Rating agencies came under significant pressure in 2008 for failing to signal the lending crisis. We note the ESG considerations of all three major global rating agencies, S&P; Moody’s, and Fitch through our interaction (7 April 2020). The observable risks and opportunities impact the credit quality of companies. Ratings factor into account the response to strategic risks that emerge and management thereof. The “S” – social risk – considers workforce, diversity, safety, customer and community among other factors. Emerging market countries are presenting vulnerability. These risks impact companies in first line of fire where complete disruption of business occurs such as travel, healthcare, retail and hospitality sectors. Second-line businesses are the rest within the economy that suffer, but are able to operate remotely, such as financial services and oil and gas. |

What should a company have in its quiver?

The value of a business post Corona

Companies will be measured by their agility at this inflection point. Flexible methods of work, embracing trust, and valuing employee loyalty become the norm. Business preparedness becomes an agenda item on management committees.

We think that whilst these are robust responses in the short term, there are two more nuggets to note: Firstly, the clarion call for climate change strategy and a company’s response to United Nations Sustainable Development Goals (SDGs). Secondly, the companies of tomorrow will add long-term value, not by marketing ESG and philanthropy but by linking their strategy intricately to externalities that affect the business. Consider Covid-19 your dry run. Business is unusual.