The four main pillars of Guernsey’s finance industry are receiving timely exposure in China this week.

The four main pillars of Guernsey’s finance industry are receiving timely exposure in China this week.

The Island’s banking, private wealth, investment and insurance sectors are all featuring heavily in meetings that a Guernsey delegation is having with regulatory authorities, association networks and financial services businesses in Beijing and Shanghai.

Deputy Kevin Stewart, Guernsey’s Commerce and Employment Minister, said: “This week has been very positive. We have had a large number of meetings with a range of different regulatory authorities, industry bodies and financial services businesses.

“They have given us the opportunity to highlight that Guernsey is a well-regulated, compliant and cooperative international finance centre and also showcase the strength of the four main pillars of our finance industry – banking, private wealth, investment and insurance.

“It has also been very good timing because only last week the Chinese Government concluded its Third Plenum where a number of economic reforms were announced. This will see a further opening up of the Chinese economic system which will present increased opportunities for Guernsey and so it is timely that we are able to bring our message to these influential players just when it is so high on their agenda.”

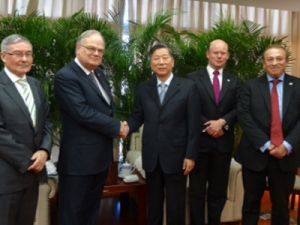

As well as Deputy Stewart, the delegation comprises Deputy Peter Harwood, Guernsey’s Chief Minister; William Mason, Director General of the Guernsey Financial Services Commission (GFSC); Fiona Le Poidevin, Chief Executive of Guernsey Finance – the promotional agency for the Island’s finance industry internationally; and Wendy Weng, Guernsey Finance’s Representative in Shanghai.

Also attending is Alan Chick, Chairman of Richmond Fiduciary Group, who opened an office in Shanghai at the end of last year which is headed by Jing Zhang.

Mr Mason signed a Memorandum of Understanding (MoU) with the China Securities Regulatory Commission (CSRC) on Monday and was also able to reaffirm the GFSC’s commitment to a similar agreement signed with the China Banking Regulatory Commission (CBRC) in 2011 during a meeting with its Chairman, Shang Fulin.

That meeting – and other discussions with private banks headquartered in Beijing and Shanghai – centred on Guernsey’s initiative to encourage Chinese banking groups to establish operations in the Island, which would provide private banking and wealth management services to wealthy individuals and families based globally.

The CBRC is also responsible for the supervision of the Chinese private wealth sector and there was an exchange of ideas about standards, including the fact that Guernsey regulates trust providers to provide trust customers with assurance as to the reliability of Guernsey trust structures.

The delegation also met with Sun Jie, Chairman of the Asset Management Association of China (AMAC), which was established around 18 months ago, to discuss how Guernsey could access its network and the possibility of collaboration with the Guernsey Investment Fund Association (GIFA).

Other meetings were held with local fund managers as well as global professional services firms, such as PwC and Deloitte, who service investment funds, including private equity where Guernsey has a strong reputation.

A further meeting was also held with the China Insurance Regulatory Commission (CIRC) to discuss Guernsey’s experience and expertise in captive insurance, which is a relatively new but emerging concept in China.

Miss Le Poidevin said: “It has been an extremely productive week raising the profile of Guernsey’s finance industry among decision makers in China. We have been able to showcase both the breadth and depth of Guernsey’s service offering and it came at such an opportune time given the continued liberalisation of the Chinese economy.

“In particular, the changes in China will present increased opportunities for inward and outward investment. We believe that Guernsey has a role to play as a gateway between China and the wider capital markets so it has been ideal timing that we have been able to highlight our credentials to so many key influencers.”

Meetings in Beijing concluded at the office of the British Ambassador to China with Dr Catherine Raines, Minister of the British Embassy and Director General for UK Trade and Investment (UKTI) in China.