Jersey and Guernsey are planning to borrow £500m each to keep each island afloat as the virus crisis strikes a debilitating blow to the public purse.

Last month, Jersey’s States Assembly agreed to re-write public finance rules, giving the Treasury Minister emergency powers to borrow up to half a billion if necessary.

At the time, it was undecided how much Treasury seek to borrow.

But, following questions from Express, Assistant Treasury Minister, Senator Ian Gorst, has now confirmed that, having assessed the likely level of financial damage covid-19 will cause, they are planning to withdraw the full £500m allowed.

“…The current preferred option – although this needs to finally be approved by the Minister and she will have to discuss with Council colleagues – is to go up to that maximum that’s allowed using a short credit facility that’s two to three years with the banks,” he said.

Video: Senator Gorst responded to questions about borrowing from Express at a press conference.

Government accounts have already been hit by hundreds of million in the form of support schemes to keep businesses running and able to pay their employees throughout the crisis.

Senator Gorst also warned of cash flow issues in the form of shortcomings in tax takings and revenue losses as a result of GST and Social Security payments being deferred.

The States of Jersey 2019 Accounts, which were quietly published at the beginning of this month, show that personal income tax brought in £475m, company income tax generated £116m, GST takings stood at £90m in GST, while Social Security contributions stood at £233m.

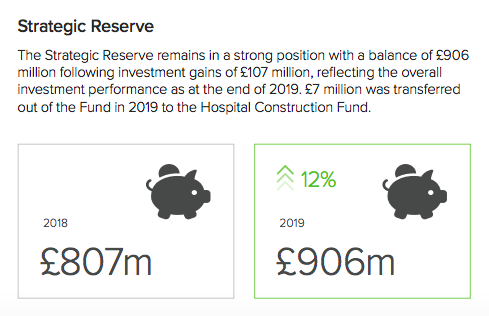

Meanwhile, the Assistant Treasury Minister said that the 30% drop in global markets caused by the pandemic had also hurt the island’s ‘rainy day fund’.

It stood at £906m at the end of 2019, but has since dropped to around £750m.

Pictured: An extract from the Accounts relating to the rainy day fund.

Guernsey is also looking to borrow £500m.

The island’s Policy and Resources Committee – responsible for the management of public finances – has put together the proposals to borrow, while also taking £100m from Guernsey’s ‘rainy day fund’ to see the island through the pandemic storm.

In a policy letter, the group said that they didn’t yet know what impact the health emergency would have on the economy, but expected to require at least £250m.

The idea will be put to a vote among Guernsey's States Members.

Debate has already begun in Jersey over how any borrowing or use of the rainy day fund will have to be repaid.

It was ignited by Senator Gorst several weeks ago when he warned that “there is no such thing as free money” and that taxes would likely have to rise.

Pictured: Both the Treasury Minister and Assistant Treasury have said taxes will have to rise.

The Treasury Minister, Deputy Susie Pinel, repeated that stance at a States Assembly meeting this week, telling her political colleagues that it would be necessary to fill the inevitable “massive black hole” in public finances, and that future generations should not be left to “pick up the pieces”.

The Economic Development Minister, Senator Lyndon Farnham, said he wished to distance himself from the remarks, adding that he didn’t think it was the right time for speculation about how to replace spent savings.

Former Chief Minister Frank Walker also took a critical view of the comments regarding tax rises, saying that the government should be looking to replenish funds over the long rather than short term.

"The Rainy Day Fund took decades to get to its current level and there is no way we should be looking at replenishing it in the short term," he tweeted.

"We need to develop a joined-up plan to use it sensibly in support of the economy and build it up again over the next few decades."

Pictured: The Economic Development Minister said he wanted to distance himself from talk of tax rises.

When Express asked Senator Gorst for a response at this week’s press conference, he replied: "We come into this crisis in a very strong position, but it would be equally wrong for Ministers not to say, when we are rightly providing support to islanders to stay in their jobs, that we will need to, in time of course, repay that borrowing.”

He continued: “Let me be absolutely clear that since I’ve moved into Treasury I’ve been reviewing the numbers on a daily basis. And of course it’s going to be challenging… having looked at those numbers, and also thinking about the extra money we’re going to need and will put into the economy through the recovery phase, we will have to trim our own spending.

“I believe that if we come together as a community… even though it’s going to be challenging, we can come out of the other side of this crisis and the recession that the FPP said we will encounter, a global recession.

“But if we come together and think about using technology, entrepreneurs and the way that we do business here and support one another, moving to a Living Wage economy, asking ourselves, ‘What is the vision for Jersey in the future?’, I think, even with those difficulties, we can come out of this in a strong position and face the future together.”

Pictured: Senator Gorst said the island shouldn't be worried about tax rises, and that how they will be applied will be decided "together".

Senator Gorst added: “Islanders don't need, I believe, to be worried about the issues of tax rises. We'll decide that together. Despite that, I believe we can come out of this in a very strong position."

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.