Employers have so far repaid £4.6m out of the £7.4m overclaimed as part of the Government's covid job retention scheme.

A total of £141m was paid to local employers and self-employed people as part of the Co-funded Payroll Scheme between its launch at the beginning of the pandemic in March 2020 and its closure at the end of January 2022.

In her reply, Deputy Susie Pinel said a total of 543 repayment requests had been fully repaid so far. This include 422 employers and 121 self-employed individuals, some of whom may be associated with the same business.

70% of repayments were made within 30 days, 90% within six months and 2% after one year or more.

Pictured: The co-funded payroll scheme was launched at the beginning of the pandemic in March 2020 and ran until its closure at the end of January 2022.

Following questions from Express, Ian Burns, Director General of Customer and Local Services (CLS), confirmed employers, who claimed a total of £122m, have so far repaid £4.6m out of the £7.4m they overclaimed.

In addition, the department has contacted 645 self-employed individuals who overclaimed a total of £3.62m of CFPS. Express asked how much of this sum had been repaid last week but has not received a response.

In his reply, Mr Burns echoed Deputy Pinel's defence of the scheme in her letter to Scrutiny, saying: “At its peak, the Co-funded Payroll Scheme (CFPS), supported more than 15,000 Islanders and almost 4,100 businesses.

"The scheme was implemented to support businesses during covid-19 pandemic and over £141m has been paid to employers and the self-employed since March 2020."

Pictured: A local accounting firm has been tasked to carry out the audit of business detriment.

Mr Burns explained that claims were audited throughout the duration of the scheme with the process continuing following the closure of the scheme earlier this year.

The Government has hired a local accounting firm to carry out the audit of business detriment whilst CLS employees have been comparing claims against contribution schedules as well as CFPS income declarations with the relevant comparable tax declarations.

In the case of claims by self-employed individuals, the audit process hasn’t concluded yet.

“For self-employed businesses, our auditing compares the amount claimed through CFPS with the individuals 2019 tax return,” he said.

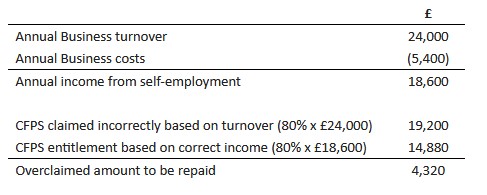

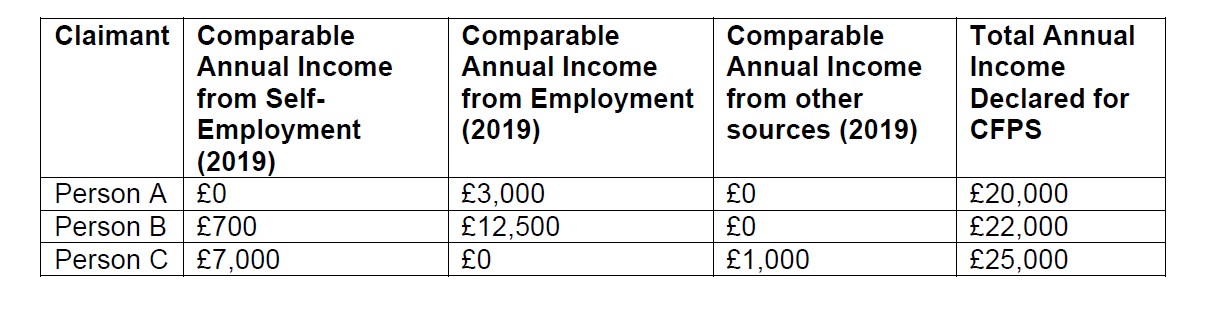

“An overclaim occurs when someone has declared in their CFPS claim more income than they have declared on their 2019 tax return. This is typically because they have in error used their turnover to claim for CFPS.”

Pictured: Mr Burns said issues with overclaims have been caused by selft-employed individuals using their turnover to claim for CFPS, rather than their annual income.

The Treasury Minister said that businesses and self-employed individuals have been informed they have up to two years to repay the amount overclaimed.

“In the vast majority of cases, the default payment period of two years represents a very reasonable amount of time for repayments to be made,” she wrote. “The median repayment required is less than £1,600 and more than 80% of repayments are for less than £5,000.”

For larger repayments, Deputy Pinel said the team at CLS would take a case-by-case approach that considers “affordability”, allowing up to five years to repay if a customer can demonstrate that repaying within two years would cause them “financial hardship”.

While she agreed with the Panel that most of the overclaims were the result of “honest mistakes”, with the most frequent mistake having been people declaring their business’ turnover rather than the amount they personally receive as income from the business, Deputy Pinel said that for many of the largest repayments “a reasonable person would have been expected to have acted differently”.

She said there were examples where people claimed subsidy payments “far in excess” of their income, the reasons for which she said are unclear and might require investigation by Revenue Jersey, and should have contacted CLS when they received a payment that was far in excess of their usual income.

Pictured: Examples of overclaims that have led to a large repayment requirement provided by the Treasury Minister.

“In examples like this, we consider that people have potentially taken advantage of a Scheme that was set up to protect jobs and businesses by making urgent payments on trust and applying the necessary control checks later,” Deputy Pinel wrote, adding she didn’t think it would be “appropriate” to provide more generous repayment terms to those who have acted in this way.

According to the figures Deputy Pinel provided, among those who have requested an instalment plan to repay their overclaim, 50% will repay within 18 weeks, 80% within 12 months, 90% within two years and 8% over a period greater than two years.

In addition, Deputy Pinel said CLS have been informed 172 self-employed individuals are intending to provide further evidence or discuss their 2019 tax submission with Revenue Jersey.

So far, 27 businesses have had their requests for repayments revised, six of which were described as “other passenger land transport” and five as “hairdressing and other beauty treatment” businesses.

In addition, 29 businesses had their repayment requests cancelled altogether after they provided further evidence. Nearly a quarter of those (7) were in the construction industry.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.