Jersey needs to embrace artificial intelligence to tackle the technology-driven increase of financial crime – and it needs to act fast, according to the regulator's Head of Innovation.

As he approaches the end of his first six months in his role at the Jersey Financial Services Commission, and to mark Digital Day, Anthony Brennand spoke to Express up about the importance of AI in tackling financial crime...

He also explained how this could help to mitigate the impact of Jersey's ageing population.

Mr Brennand has over 20 years of experience in product management and innovation.

Pictured: Anthony Brennand is Head of Innovation at the Jersey Financial Services Commission.

Before joining the JFSC, he worked as a Director of Innovation developing blockchain and AI-powered products from concept through validation, development and 'go-to-market'.

However, he has now turned his attention to 'RegTech'.

Regulatory compliance technology (RegTech) is an emerging field of technology which is revolutionising regulatory compliance – particularly in the financial industry.

The timing is particularly poignant, with the Government's RegTech super-deduction set to come into force this year.

This tax deduction is designed to encourage financial services companies to invest in regulatory compliance technology (RegTech) that aligns with the standards of the Jersey Financial Services Commission (JFSC).

This year of assessment 2024, eligible companies are able to deduct 150% of qualifying expenditures related to the purchase and implementation of RegTech in the year of acquisition.

Mr Brennand explained that it is a "really exciting time in technology generally".

"Everybody's using AI in some form or another," he said. "Whether it's formally going into Chat GPT, or whether it's a plug-in on an established product that they use every day, and don't even realise that it's doing that."

The Head of Innovation explained that – like almost every other sector – many of the emerging RegTech solutions are AI-powered.

Pictured: "Everybody's using AI in some form or another."

"I think, because of technology, the rise in the volume of financial crime is increasing," he said. "International bodies are reacting with lots of different regulations that they expect different jurisdictions to comply to."

This can be difficult for jurisdictions without up-to-date technology, explained Mr Brennand, as it then comes down to "people play".

"Where do we get all those people?" he asked. "If we don't start using technology to do this, then we're simply just not gonna be able to keep up [with increasing regulations]."

Mr Brennand explained that is particularly crucial in Jersey due to the island's "certain problems" such as "the scarcity of resources" and lack of "skilled people in certain key areas".

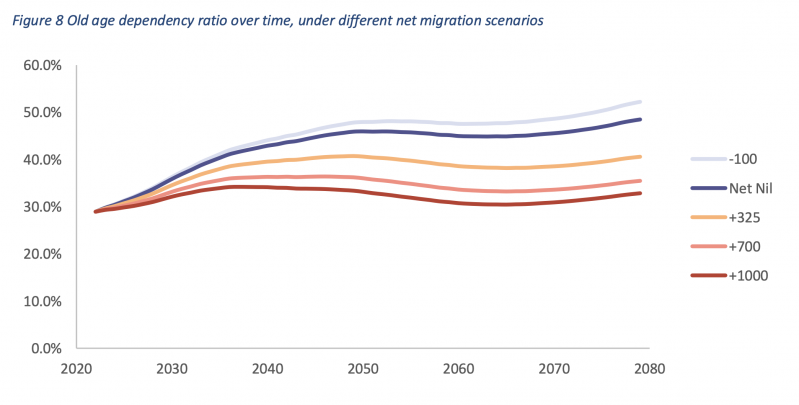

"That scarcity of qualified resources becoming more and more apparent," he said. "It's only going to get worse; we've got an ageing population."

Mr Brennand added: "If you just look at the Government's stats on population growth, unless we make a political decision to expand the populations dramatically, by 2035, or whatever it is, we're gonna have a situation where we've got not enough people at all in the working population support those who are not working."

He explained that local businesses are "competing for fewer and fewer people to do this work" – however, Mr Brennand said that AI offers the opportunity for increased capacity and efficiency.

"Just think about the kinds of activities you can do with AI," he said.

"Things like RegTech allow you to do a kind of an analysis of financial crime, for instance, that you could never do before you even if you had 20 people looking at it – whereas the machine can do that."

Mr Brennand explained when you have a "risk", such as Jersey's ageing population, and a "real opportunity", like the use of AI, "both working together, naturally, you get industry talking about it, you get governments and you get agency talking about".

Pictured: Jersey's old age dependency ratio over time, under different net migration scenarios. (Statistics Jersey)

“Our main objective really is to achieve operational efficiency, or effectiveness – that's the key in regulatory compliance; that's the thing that we're talking about all the time in this fight against financial crime.

“On the one side, technology is making it easier for bad actors to attack the systems and guardrails that you've got in place globally – just, if nothing else, through sheer volume.

“At one time, if you wanted to create a fake ID, for instance, in order to setup some money laundering approach, then you’d have to go through constitutional means of doing that.

“Whereas now, technology can mean that you can create multiple IDs at the same time, and then attack lots of different places. So the only way to really come back is going to be through the use of RegTech on the other side of it.

“And that's why things like digital IDs and these onboarding systems that are able to demonstrate that something is real or not, are invaluable.”

Mr Brennand explained that this is especially useful for an international finance centre like Jersey, which has a “global reach” and customers for lots of different places.

He used the example of a new customer presenting an ID document to open a new account.

Mr Brennand explained that it would be difficult for a human member of staff to verify if the ID document was real if it happened to be “a driving license from 10 years ago, from a country that they’d never come across”.

However, AI can easily “do the analysis of the image and compare it to highlight to pinpoint accuracy if it's legitimate”, he said.

This is a key example of the use of RegTech is during the onboarding process.

This is all activities involved in introducing a new customer to a financial provider's products and services.

The onboarding process ensures regulatory, legal, and credit-related due diligence – including know-your-customer (KYC) checks and procedures such as ID verifications and document collection.

Mr Brennand explained that RegTech "can really help expedite that process" though the use of a digital ID, for example.

He explained: "Currently, lots of companies are finding that it can take six to eight weeks to open new accounts and things.

"It takes a lot of people, and so there's a lot of activity around that trying to solve that problem.

"And some of them, of course, are technologies that can be used for other purposes.

"So things like a digital ID [can have] lots of different use cases, in both your personal life or work life.

"It means that a lot of the work has already been done, it can be reused."

Pictured: A digital ID can be reused in both work and personal life.

Mr Brennand continued: "Every time you buy in different financial products, you don't have to go through that whole same process again.

"So for for the consumer, it's much better, and for the financial services entity it's much quicker and it doesn't take as many people doing manual tasks – so there's real benefits to be had."

However, he admitted that people can a "little bit risk averse" when it comes to RegTech solutions, particularly in the regulation or compliance industry.

Mr Brennand explained: "I think it's knowing or feeling confidence that if they do invest in a technology solution, that it's not going to cost them more issues when it comes to talking to the regulator."

However, he believes that that perception can be altered through education and "familiarity".

The Head of Innovation said: "I think where people have more direct access to the benefits [of AI] and see the benefits in their daily lives then, no matter how old they are, they'll make a call about whether that's for them or not.

For people who don't have that insight or haven't got that familiarity with it, then it can seem daunting and it can seem scary in some cases."

It all comes down to "acceptance and perception", he added.

Digital Day is an All Island Media initiative exploring the potential of technology to transform Jersey's future.

If you want to learn more, you can listen to our three special edition podcasts, with Digital Jersey, Ports of Jersey and the JEC.

You can also read a special edition supplement from our sister publication, the JEP, where you can learn more about the potential for digital across health, environment, and other areas of island life.

Digital Day is here!

— Bailiwick Express (@bailiwickxpress) January 30, 2024

Watch/listen to three insightful podcasts on the ever-changing impact technology has on the island.

Listen to the full podcasts in the JEP Digital Day supplement, starting on page 23:https://t.co/pEA1ZYu9Cz@DigitalJersey @PortsofJersey @electricjersey pic.twitter.com/dMIlLcsiBC

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.