A faulty trust set up by a solicitor-turned-pornstar’s firm that would have drained a couple’s retirement cash has been voided by the Royal Court.

The inheritance tax-proof ‘trust’ was created for couple Anthony and Lorraine Bell by English firm Baxendale Walker on the advice of their son-in-law William Auden, who worked there.

Despite being run by an Oxford-educated author of a number of legal textbooks, Paul Baxendale-Walker, the Court found the firm's tax advice to have been defective and likely to land the couple in trouble with HMRC.

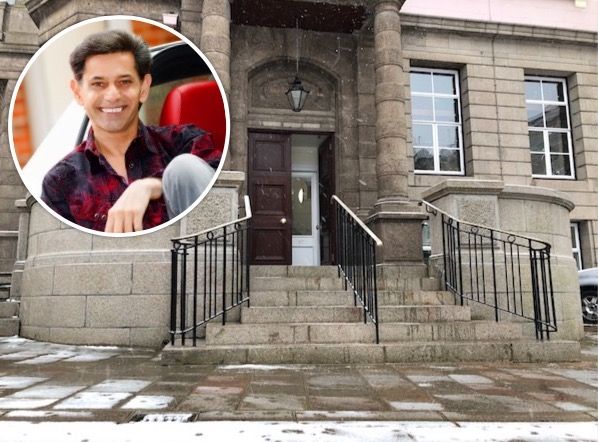

The Bells brought their case to have the trust dissolved to Jersey’s Royal Court after learning of other cases involving the now defunct firm and its owner Mr Baxendale-Walker, who hit headlines after being struck off the roll of solicitors before purchasing Loaded magazine and becoming an adult film company owner, producer and actor.

Pictured: Owner of the firm Mr Baxendale-Walker, appearing on his TV show 'Looser Women'. (Old Bedan/Wikipedia)

The Court heard how son-in-law Mr Auden – now also banned from practising law – set up an arrangement whereby the couple handed over beneficial ownership of their assets in return for annual payments from their 75th birthday onwards.

The money for this was to come from a trust incorporating their Derbyshire home, Hob Cottage (worth £395,000), a managed portfolio worth £240,000 and £52,000 in National Savings Bonds, and Jersey-based Atlas Trust was proposed as trustee.

Over a number of years, payments were made out of the trust as ‘loans’ to Mr and Mrs Bell, including one of around £19,000 as well as further sums of between £5,000 and £10,000 over the following 10 years.

The couple did not want to liquidate their cottage home, so it was proposed that they enter a seven-year tenancy agreement with Atlas as landlord, although the Bells did not end up paying any rent on the property, whose lease expired in 2010.

This gave rise to one of the trust’s biggest flaws – as the house was a ‘restricted asset’ and could not be sold because it was their home, there wouldn’t be enough money left to provide for the couple into their old age.

Pictured: Under the agreement, the Bells' Derbyshire home was not to be sold so that they could continue living there. (Google Maps)

According to the Court judgement: “None of the trustees have ever held substantial funds from which annuities could have been paid without exhausting what was available in relatively short order… It would have been impossible for an annuity to be paid to the Representors after a number of years particularly when Mrs Bell’s payments fell due. It is clear that the Trust had no prospect of being able to make the annuity payments on the basis of the calculation that they had advised should apply – the cash would simply have run out.”

Moreover, neither Atlas nor later trustees Nautilus and Valla had a permit to pay annuities – a requirement under the Insurance Business (Jersey) Law – meaning that Atlas was guilty of a criminal offence when it paid £11,000 to Mr Bell on his 75th birthday.

Perhaps worst of all, Baxendale Walker’s advice could have landed the Bells in trouble with HMRC, who, according to the judgement, “would find that there had been a tax avoidance motive.”

In his concluding comments, the Deputy Bailiff remarked: “We are entirely satisfied that the Representors entered into all of these transactions as a result of the mistake created as a direct consequence of the erroneous advice received from Baxendale Walker. Without that advice they would not have done so. The mistake was serious and we are satisfied that we should set aside all and any transfers and declare that the Trust is void and it was void ab initio.”

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.