The Jersey Teachers Superannuation Fund (JTSF), which offers pension benefits calculated on a ‘final salary’ to its 2,700 members, has been described as “unaffordable” with a projected deficit of £20 million.

That’s despite the pot having been £77 million' in the black’ as of the end of 2016, due to investments returns and pension increases being lower than expected.

But this extra money has been reduced to £35.1 million as it’s had to soak up a £42.4 million debt, and is expected to be whittled away with the scheme’s current shortfall of around £2 million every year.

Based on the recent number of new joiners to the Jersey Teachers Superannuation Fund (JTSF), the management board who review the States pension schemes, predict this debt may exceed £20 million over the next decade stating: “Underfunding of the benefit package is unsustainable (…)The future is highly uncertain but if all our assumptions were borne out after the valuation date and there are no changes to the assumptions at future valuations, we would expect the surplus of £35.1 million at the valuation date to be eliminated over time.”

Therefore, the Board has advised the extra £35.1 million is kept in the pot “as a buffer” and not be considered for other government funding, as is the current procedure.

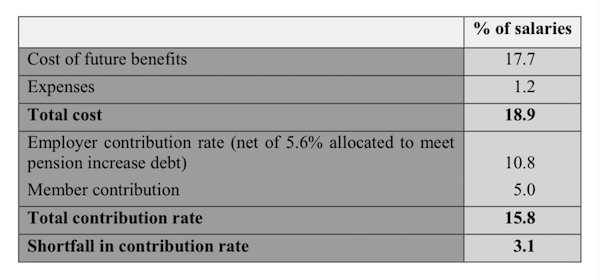

The Board blame the issue on the current pension contributions being paid, which are 5% of a member’s salary and 10.8% of that salary by the States of Jersey, to provide teachers with a lump sum payment and regular payments when they retire, as well as financial support to their family when they die. They predict that the total contribution rate needs to rise from 15.8% to 18.9% to meet future benefit costs.

Although all other States employees are going to be moved onto a ‘career average salary’ pension scheme next year, unless they are already on it or are within seven years of retirement, there are currently no plans to move teachers onto a similar scheme.

The only change the scheme has had is that new members can exchange up to 30% of their pension for a lump sum at retirement as opposed to 25% previously.

Pictured: A recent valuation report shows there is a 3.1% shortfall in contributions needed to cover future benefit costs.

But due to the financial state of the JTSF the Treasury Department have confirmed: “The actuarial valuation highlights that the contributions being paid into the JTSF scheme are not enough to fund future benefits. We are all living longer and the costs of providing pensions has increased. A review of the sustainability of Jersey’s final-salary teachers’ pension scheme is planned.”

The President of teacher’s union NASUWT, Marina Mauger, told Express: “There is a historic deficit in the scheme that the States has given an undertaking to address on many occasions, but has not yet done so. The deficit has been caused by the States failing to contribute enough in the past.”

A review of the other Pension Employee Pension Funds - the old 'final salary' scheme (PECRS) and the new 'career average' scheme (PEPS) - show there are no longer deficits within those plans and the Management Board have recommended that no changes are needed to fund future payments.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.