How many high-value residents come to Jersey each year? How much money do they bring in? And what nationalities make the most applications?

The Chief Minister has sought to answer some of these questions, ahead of several votes in the States Assembly this week which could lead to a major shake-up of what's known as the 2(1)(e) regime.

Express looks at the figures...

Treasury Minister Ian Gorst has brought forward a proposition to increase the minimum tax paid by new high-value residents (HVRs) to £250,000, potentially boosting public coffers with an extra £1.2 million in income per year.

Also up for debate is Deputy Lyndsey Feltham's proposition, lodged last month, which calls for the suspension of the Government's scheme for attracting HVRs to the island until their "unfair" preferential tax rate is axed.

Pictured: Deputies Gorst and Feltham have both proposed changed to the current HVR scheme.

Currently, HVRs pay 20% on their first £850,000 of income, and 1% on all worldwide income over £850,000. A licensed resident, by contrast, would pay 20% across the board.

In response to this, Chief Minister Kristina Moore has provided a series of figures detailing the impact of the HVR scheme on the island.

Figures demonstrate that the personal Income tax take from High Value Residents has steadily increased over time.

In 2005, High Value residents paid £7m. By 2010, that figure had risen to £10m. In 2020, High Value Residents paid £21m in personal income tax.

A recent written question by Deputy Max Andrews revealed that HVRs paid £24m in 2021, which was equivalent to 4.7% of all personal income tax paid in Jersey.

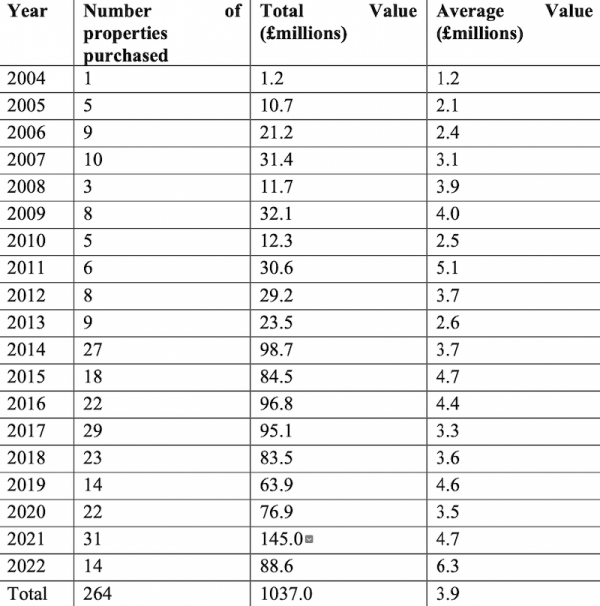

Since 2004, High Value Residents have purchased 264 properties in Jersey, totalling more than £1bn.

Pictured: Property purchases by year – 2004 - 2022.

Last year, 14 properties were purchased, with a total value of £88.6m.

Current rules state that any new HVR must spend at least £2.5m on a house or £1.25m on an apartment.

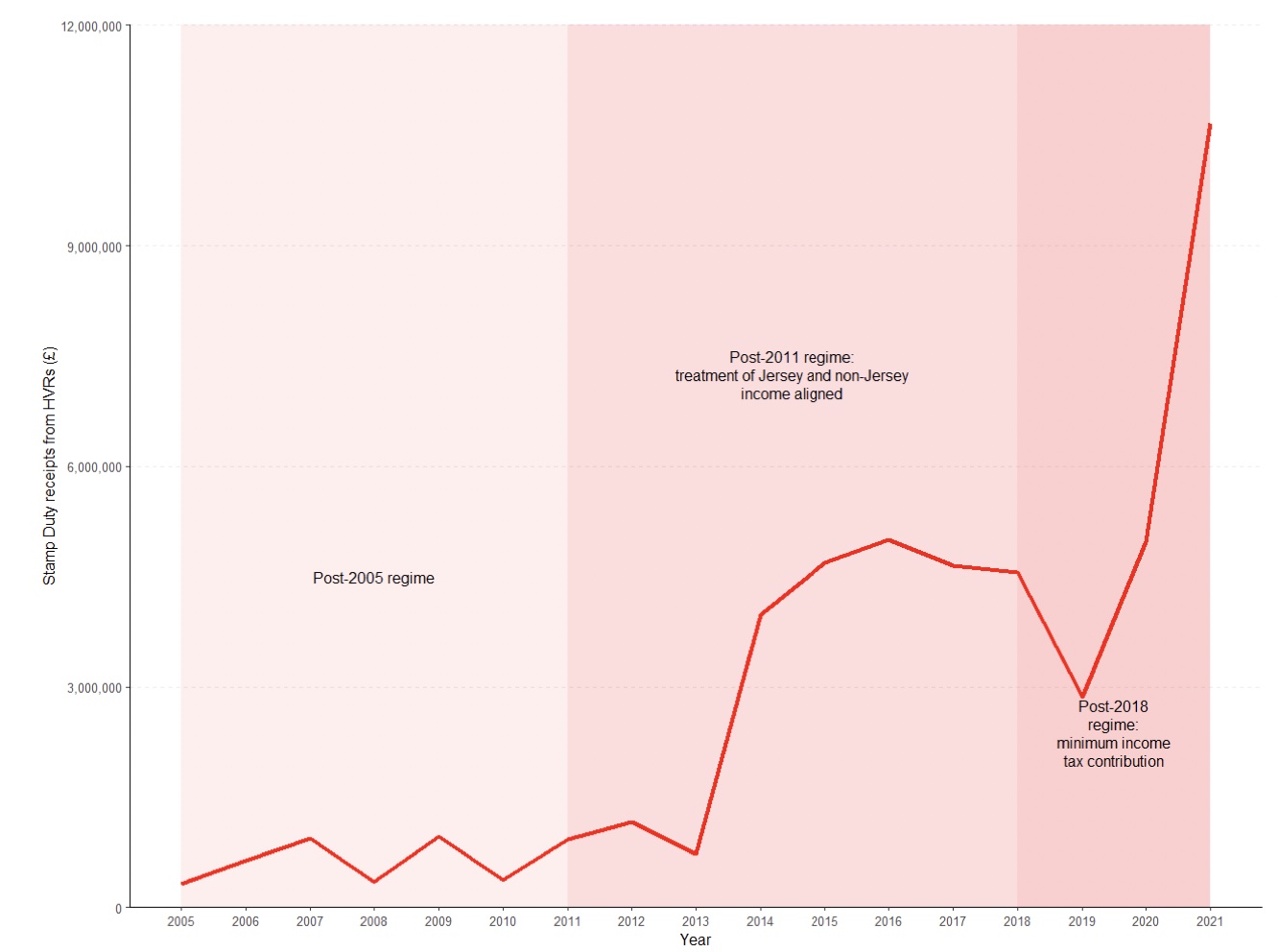

Pictured: Stamp Duty takings associated with HVR home purchases, 2015-2021.

Should Deputy Gorst's proposition go through, this will rise to £3.5m for houses, and £1.75m for apartments.

The vast majority of Jersey's HVRs applicants come from England, with 134 people applying between 2013 and 2022.

The next most common place of origin was Switzerland, which saw only 12 applicants.

Pictured: The places of origins of applicants between 2013 and 2022.

Seven applicants were Hong Kong-based, while six were from Scotland.

Fewer than five were reported as being from Russia.

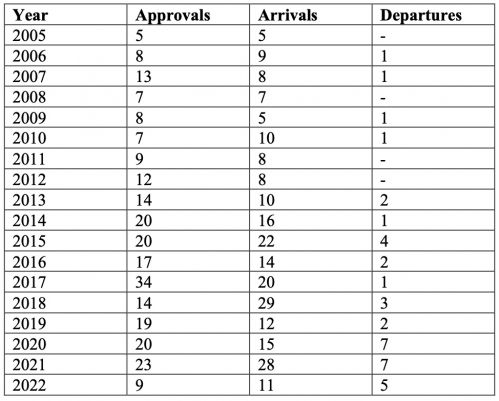

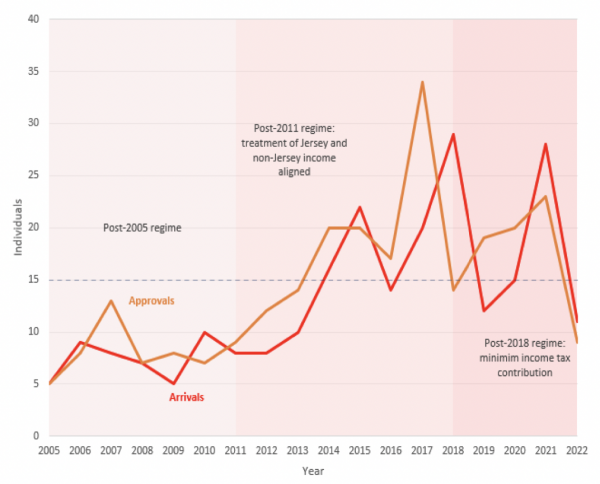

Last year, 11 HVRs arrived in the island.

The biggest influx was in 2018, when 29 arrived.

2020 and 2021 saw spikes in the number of departures, with seven people leaving in each of those years.

Those aged between 50 to 59 form the largest share of HVRs, at 31%.

Pictured: Number of approvals and arrivals in Jersey, 2005 – 2022.

Those aged between 40 and 49 are the runners up at 26%.

Only 13% of High Value Residents are under the age of 39.

Giving her view on Deputy Feltham's proposals, Deputy Moore stated that while the Government was happy to increase the minimum tax requirement for HVRs, Ministers felt removing the 1% tax provision as proposed by Deputy Feltham "would negatively impact revenues", as removing this provision would lead Jersey to lose out to competing destinations.

Pictured: Ministers felt removing the 1% tax provision as proposed by Deputy Feltham "would negatively impact revenues" as Jersey could lose out to competing jurisdictions.

She said: "Jersey has an enviable natural environment, a safe and vibrant community given our size, excellent transport links to the United Kingdom, good public services, and a critical mass in some of the key industries, notably wealth management, which attract many 2(1)(e) applicants.

"This means we can operate at the higher end of the market in terms of tax, applying strong due diligence. However, there are limits to our attractiveness, and we must remain competitive overall."

She added: "We should be positively welcoming and supportive of new migrants who move to Jersey wishing to become part of our community, including those who are wealthy."

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.