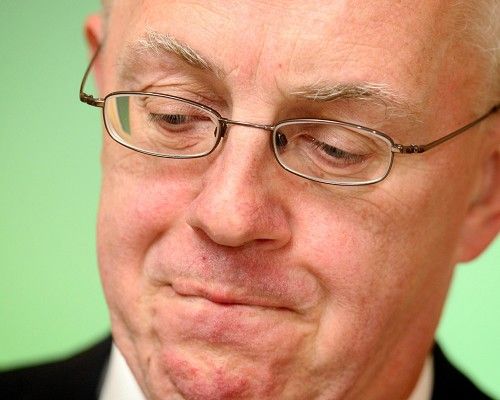

The man behind the UK's retail banking reforms has complained that his recommendations have been diluted.

Sir John Vickers, head of the Independent Commission on Banking, criticised the Bank of England's plans to build an extra buffer of capital for not being strong enough.

"The BoE is proposing substantially milder equity requirements for British banks than did the ICB. The wisdom of this policy is questionable," he wrote in a Financial Times article.

Sir John said his proposals to ringfence banks' retail operations have been watered down.

"Given the awfulness of systemic bank failures, ample insurance is needed, and equity is the best form of insurance," he added. "The recent volatility in bank stocks underlines the importance of strong capital buffers. The BoE should think again."

The ICB recommended that the six largest banks should have 3% of extra capital in reserve compared with loans, when taking into account their risk.

The Bank has suggested a buffer of up to 2.5% and only 1% for the smaller lenders of the six. Chancellor George Osborne has made a series of concessions to the City in recent months. Mr Osborne said in last July's Budget that he would gradually reduce the bank levy over the coming years.

He has also called for a ''new settlement'' to end banker-bashing and was widely reported to have ousted tough-minded Martin Wheatley, head of City watchdog the Financial Conduct Authority (FCA) in July, raising concerns about political influence at the regulator.

HSBC announced that it will keep its headquarters in London after considering moving over the prospect of stricter regulations. The Bank declined to make a comment to the FT on Sir John's concerns.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.