The amount of money pushed into Jersey’s economy by the finance sector has dropped by £670 million in 10 years, dragged down by troubles in the banking sector.

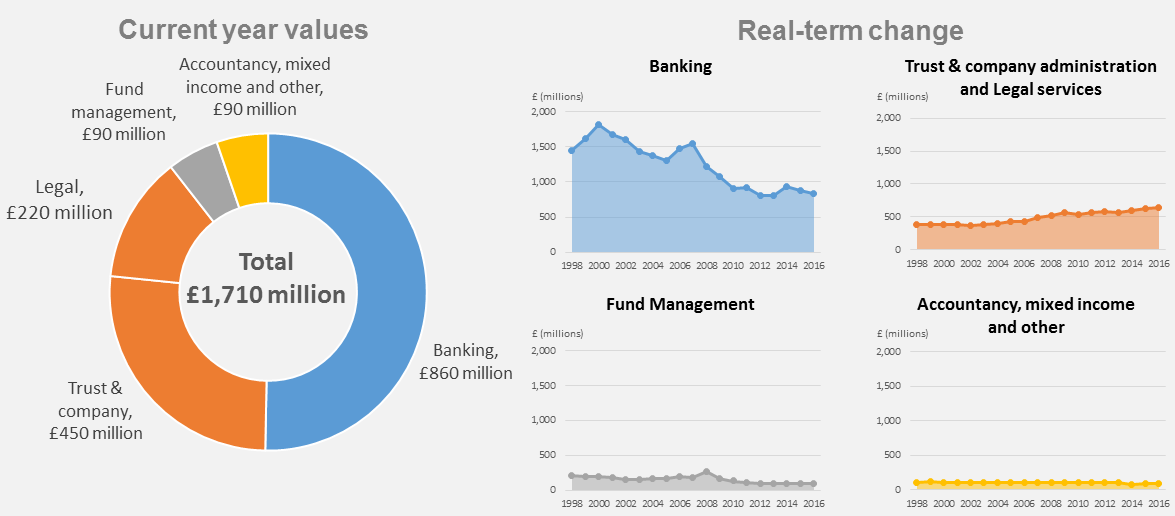

A Survey of Financial Institutions published today revealed that Jersey’s finance industry is still easily the Island’s largest money spinner, but that the amount it contributes overall to the economy (GVA) dipped by 2% last year to an overall total of £1.71 billion.

This was predominantly driven by banking, whose output declined by around £40 million between 2015 and 2016 – a decrease of 4% in their value to the economy.

However, the industry overall was largely buoyed by a strong GVA growth in the trust and company administration and legal sub-sectors.

Video: What is GVA? The Statistics Unit explains in this handy clip.

It’s no secret that banking has been troubled for some time, with falling interest rates, which represent two thirds of all revenue generated by banking activity and a quarter of the total for the finance sector as a whole, at the heart of their woes. Last year, they dropped from a peak of £1.04 billion in 2008 to £630 million.

But it wasn’t all bad news for banking, with employees rewarded the second highest bonuses in the industry, which grew to around £7,500 each on average - £800 more than the previous year.

Banking employees were, in fact, most valuable to the industry as a whole at £203k generated for the economy per head – a 1% rise from the previous year. But as States Statistician Dan Edwards explained, this may be due to a diminishing workforce working harder to compensate:

“In the banking sub-sector, we’re seeing a lot of reduction in actual headcount. It’s not like there’s still 6,000 bankers on the Island – that’s dropped by around 2,000 over the last number of years. Because they’re losing staff, if they’re doing is sensibly, they’re losing the staff who are the least productive staff.”

Pictured: Trust, company and legal services enjoyed steady growth, while banking's GVA continued to fall. Fund management and accountancy saw their output flatline. (Statistics Unit)

Productivity levels overall, however, continued in freefall – a trend ongoing since 2007 – with finance employees now 4% less valuable to the economy than in 2015 at £136k per person.

The industry overall was largely buoyed by a strong GVA growth in the trust and company administration and legal sub-sectors.

According to the report, the 13,000-employee-strong sector also pumped £370 million back into the local economy through goods and services expenditure, spanning anything from cleaning and stationary to IT support.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.