The Government recently launched a new £10 million shared-equity scheme aimed at islanders struggling to get a foot on the property ladder... but how does it work? Who is actually eligible to apply? And what sort of properties are you allowed to buy?

Housing Minister Sam Mézec said the 'First Step' assisted home ownership scheme, will enable eligible islanders to access a Government contribution of up to 40% towards the purchase of an open-market property.

The scheme – which is being delivered in partnership with Andium Homes – was previously announced by his ministerial predecessor, Deputy David Warr, in September.

Pictured: Housing Minister Sam Mézec launched the First Step scheme yesterday.

Deputy Mézec said an estimated 60 households could benefit from the First Step initiative, which utilises £10m of funding previously earmarked in the 2021 Government Plan, but that it could have a "knock-on effect in the wider market" by increasing turnover.

The scheme enables Andium Homes, on behalf of the Government of Jersey, to provide an applicant with an interest free loan – called an ‘equity loan’ – on a property they would like to buy in the open market.

A successful applicant would receive a means-tested equity loan of between 10% and 40% the market value of a property, depending on their needs.

The applicant must also contribute their own minimum 5% deposit towards the purchase price of a property and be able to obtain a capital repayment mortgage for the balance of lending with a participating mortgage provider.

The equity loan will be secured against a property in the same way as a mortgage, and attracts no interest.

A home owner under the scheme is not required to make any repayments until either they sell their home, or if they wish to buy out a proportion of the equity loan.

Applicants to the First Step assisted home ownership scheme must:

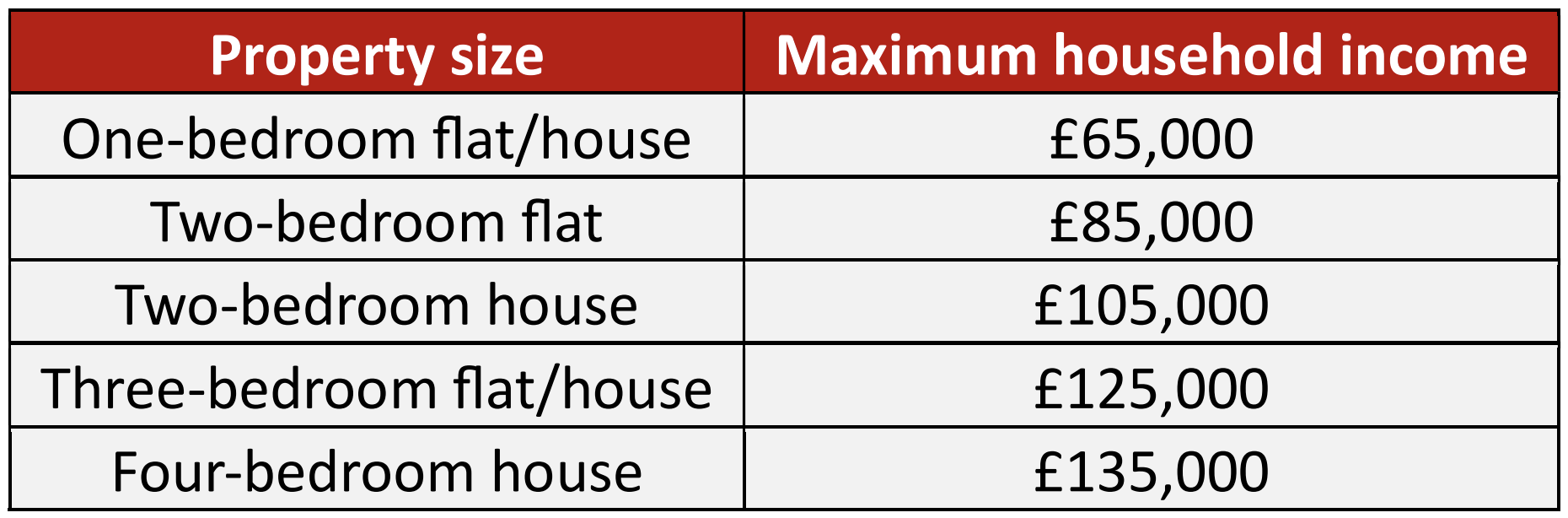

When a person applies for the First Step scheme, their initial application will be considered against the following household income thresholds:

To be eligible for the scheme, an applicant must be able to contribute their own minimum 5% deposit towards the purchase price of a property.

In addition, the applicant is expected to contribute any savings and investments they have in excess of £15,000. The amount of equity loan they are then offered through the scheme will reduce accordingly.

An applicant must also be able to meet the costs of buying a home, including Stamp Duty costs, a bank survey, mortgage arrangement fees, legal fees and insurance fees.

The First Step equity loan does not replace a traditional mortgage. An applicant must still take out the maximum amount of mortgage borrowing available to them with a participating mortgage provider.

Under the First Step scheme, an applicant is only able to buy a ‘re-sale property’ – a property that has been previously occupied or sold as a place of residence.

This includes freehold, flying freehold and share transfer properties.

Pictured: Islanders are not entitled to buy new-build properties under the First Step scheme.

However, this means that the scheme does not allow people to buy new-build properties – including conversions of buildings that have never been used as homes and occupied.

The scheme also does not apply to properties available for sale through other assisted home ownership schemes.

In addition, there is a limit on the cost of the property that the applicant can buy thought the First Step scheme.

An applicant may buy a property up to certain maximum property prices.

There are based on the upper limit of the lower quartile price of properties sold in Jersey during 2023.

These figures will be reviewed at least annually to ensure that they continue to reflect lower quartile property prices in the Jersey House Price Index published by Statistics Jersey.

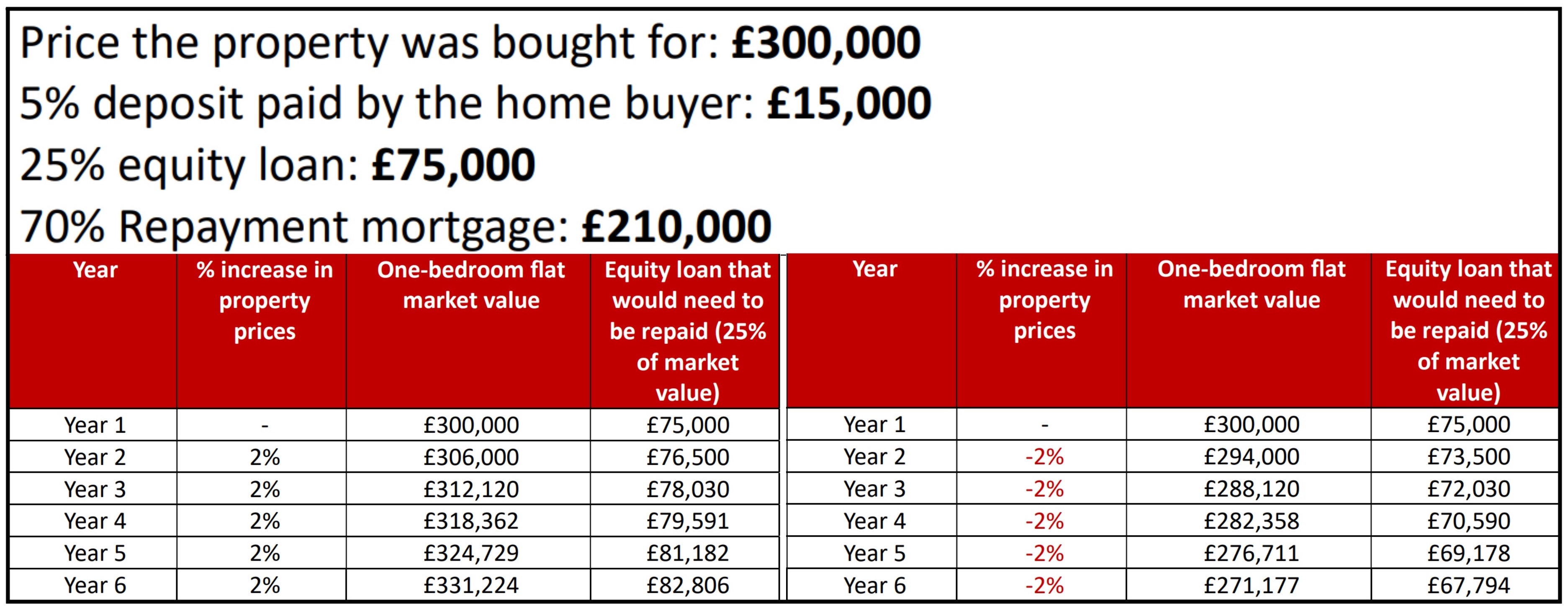

The repayment of the equity loan is calculated as a percentage of the market value of a property at that time rather than the initial value of the loan.

Any changes in the value of the property (both up and down) will, therefore, affect the amount that a home owner has to repay.

Pictured: How the loan repayment amount might change on a £300,000 property if prices increased or decreased.

Any increase or decrease in the value of the property is shared between the home owner and the Government of Jersey.

You can find out more or apply for the First Step scheme online HERE.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.