Treasury urgently had to fork out an extra £2m to help balance the books last year due to skyrocketing insurance costs ranging from transport to medical malpractice, it has emerged.

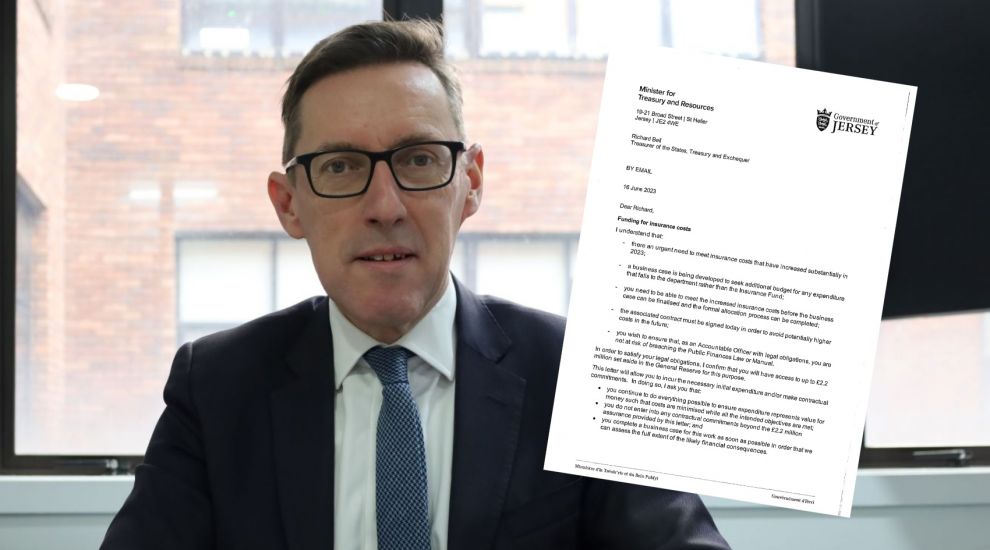

A recently published 'letter of comfort' shows that Treasurer Richard Bell reached out to Treasury Minister Ian Gorst in June 2023 to request £2.2million as part of "an urgent need to meet insurance costs that have increased substantially in 2023".

Letters of comfort are notes expressing an intention to provide financial support which are not legally binding. They are used when there is an urgent need for expenditure, but a full business case cannot be provided or considered due to time constraints.

A total of £1.9m was subsequently drawn down, bringing the total spend on insurance to £10.6m – nearly 30% more than the previous year.

The letter, which was made public following a request by Express under the Freedom of Information Law, revealed that a contact had to be signed on 16 June 2023 "in order to avoid potentially higher costs in the future".

Following enquiries from Express, the Treasury and Exchequer Department confirmed that the extra funding was needed "to achieve a balanced budget for insurance purposes" and that £1.9m had been spent.

The department explained: "The Government of Jersey insurance programme includes coverage for various aspects, including property, medical malpractice, liability/indemnity, personal accident and travel, motor fleet, and engineering machinery.

"The costs associated with these premiums amounted to £8.3 million in 2022 and £10.6 million in 2023."

A report penned by the spending watchdog, Comptroller and Auditor General Lynn Pamment, found in 2020 that the Government was exposing itself to more financial damage from claims against it due to poor insurance arrangements.

The government uses both external insurance and self-insurance via an Insurance Fund to mitigate risk.

Reasons that the government might have to use its insurance could involve pay-outs to employees or members of the public for accidents on government premises or legal claims against the Health Minister for operations or other health procedures going wrong, for example.

Ms Pamment found that, until that point, there had been little governance and oversight of the States’ insurance arrangements. Treasurer Richard Bell said at the time that the Government welcomed her recommendations for improvement.

In 2021, Express reported that insurance premiums to cover medical claims against the Government had risen by £1m – in part caused by a rise in claims locally. In particular, a rise in maternity cases was highlighted.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.