There has been a surge in drivers looking to save money and the planet with an electric vehicle, but, high purchase and insurance costs risk slamming the brakes on the island’s green transportation motives.

But why does it cost so much more to insure an EV? And could prices ever come down?

Express spoke to a local insurance provider to find out...

Jersey is currently on course to ban the sale of petrol and diesel vehicles by 2030 as part of its commitment to achieving net-zero carbon emissions.

The transportation sector currently accounts for 41% of Jersey's total emissions, with electric cars being a relatively low-carbon alternative to fossil-fuelled vehicle.

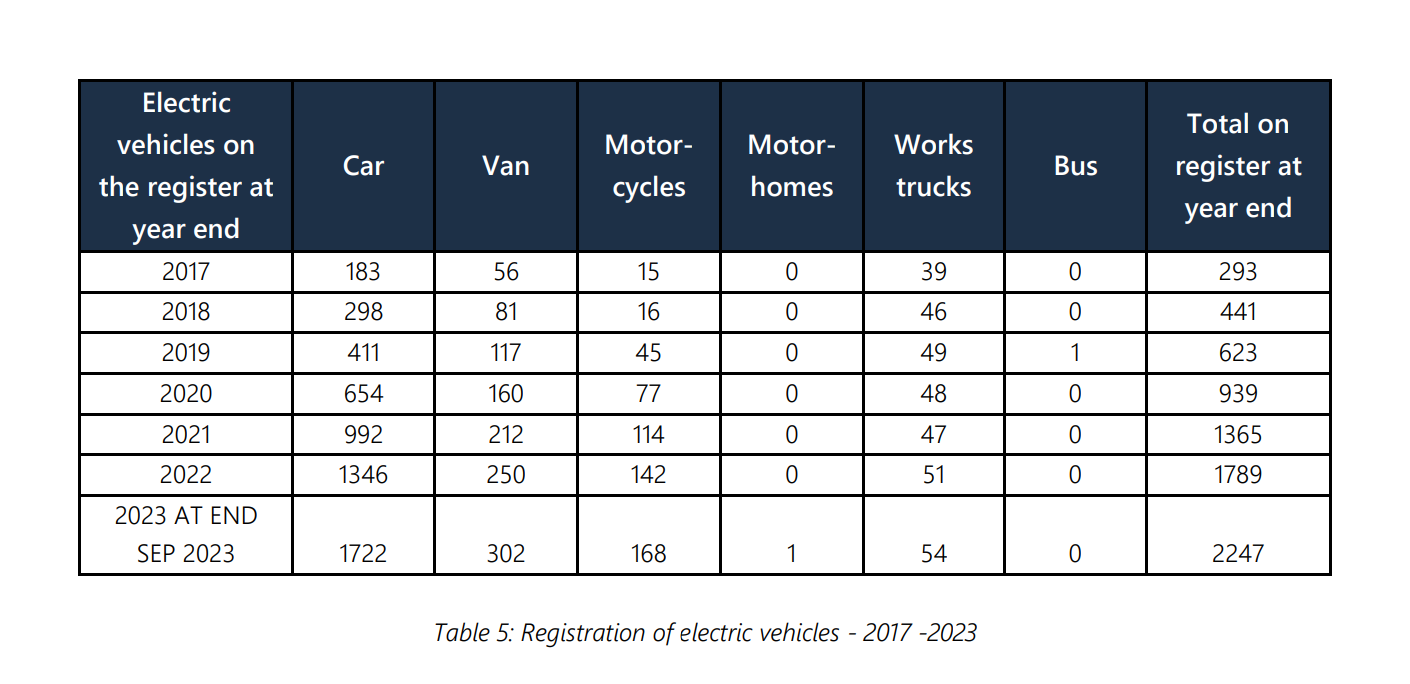

Pictured: A table from the Sustainable Transport Policy Report shows the growth in electric vehicles over recent years. (gov.je)

However, currently, only 7% of Jersey residents have hybrid cars and 4% have electric ones, though these numbers have grown over recent years.

That may be because, instead of being rewarded for efforts to combat carbon emissions, drivers who make the switch are hit in the pocket.

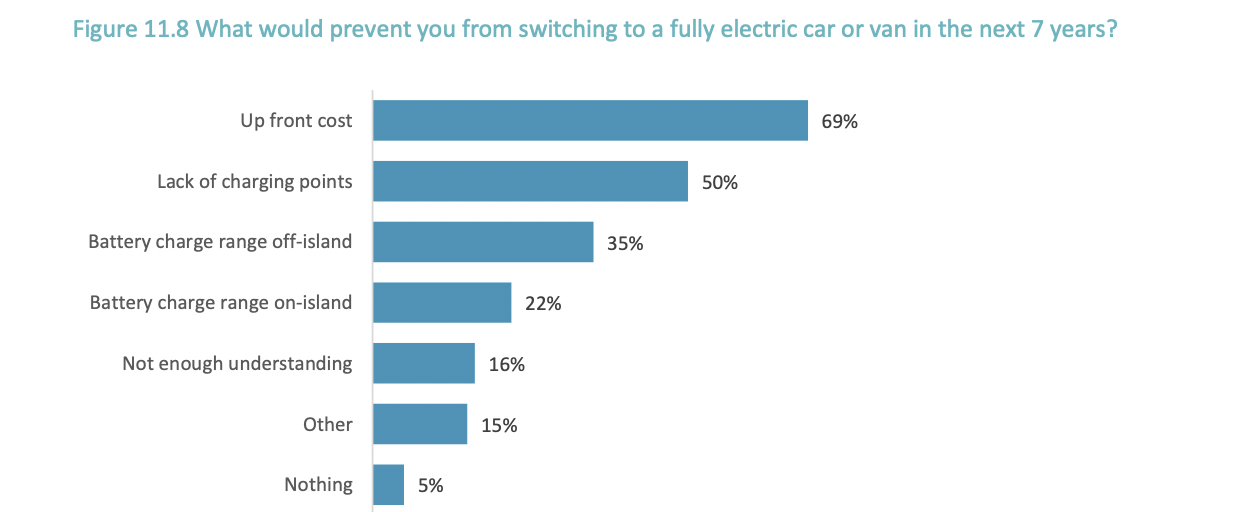

A recent survey suggested that as many as one in three island households would consider buying an electric vehicle by 2030 – but that the main barrier is cost.

Pictured: Almost 70% of respondents said that the main barrier to switching to electric vehicles was the upfront cost. (Statistics Jersey)

Government grants currently cover 35% of the electric vehicle cost, up to a maximum of £3,500, and can be used on electric cars or vans costing up to £40,000 through approved retailers in the island.

But even those who are able to afford a new vehicle will then have to contend with much higher insurance costs.

"On average, the cost of claims for electric cars is about 50% higher," Islands Insurance told Express.

“On average, the premium for popular electric vehicles such as the Renault Zoe, BMW i3, and Kia Soul is around £600 to £650.

"For a specific comparison, a quote for a Fiat 500C Passion Electric, model year 2023, is approximately £510.00, marking an increase of £70.00 over its petrol counterpart, without considering the vehicle's age in the calculation.”

They said that the challenges in insuring electric vehicles are due to limited repair facilities in the Channel Islands, higher repair costs due to specialised EV parts.

These challenges contribute to electric cars being classified into higher insurance groups.

“There's a bit of a challenge with repairing electric cars, especially the higher-end vehicles like Teslas," Islands Insurance explained. "If they get seriously damaged, fixing them can be difficult because there aren't any approved places to fix them in the Channel Islands. The nearest one is in Normandy.

“This issue is all about finding the right place for repairs and doesn't change our willingness to insure electric cars.”

They also explained that due to their increased risk, electric cars are often classified into higher insurance groups by organisations that collect vehicle data on behalf of the insurance industry.

The lack of information about EVs could also be a contributing factor, Islands explained.

“Electric cars are also quite new on the scene, which means there's not as much data from past insurance claims," they said.

"This data is really important for insurance companies to decide how much to charge. Since most electric cars have been around for less than five years, there's just not enough information yet.

"This makes insuring them a bit of a guesswork, which can push prices up."

There is, perhaps, some hope on the horizon.

"As more electric cars hit the roads and more data becomes available, we expect insurance prices to become more stable and maybe even cheaper," Islands Insurance said.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.