Jersey has given its backing to an “historic” global tax agreement, which features certain carve-outs for finance firms.

The island has joined 130 out of 139 jurisdictions forming part of the OECD Inclusive Framework, which seeks to establish new rules for the taxation of the world’s largest multi-national companies.

The island has been able to attract business over many years by keeping its corporate tax rate at 0%, with financial services businesses taxed 10%. This is known as the 'zero-ten' regime.

Each of the signing jurisdictions has committed to a ‘Two Pillar’ plan.

‘Pillar One’ would create new profit allocation rules for the world’s largest 100 global multi-national companies, who might have to re-allocate some to the jurisdictions of their markets and customers. All regulated financial services are excluded from this.

'Pillar Two' would introduce a new framework of taxation where companies falling within the scope of the Pillar Two tax would pay a Minimum Effective Rate of taxation on their global profits, calculated on a country-by country basis. This does not include funds.

Investment funds that are ultimate parent entities of a Multi-National Company Group or any holding vehicles used by such entities, organisations or funds would not be subject to the Pillar Two rules.

The level of the Minimum Effective Rate contained in the OECD statement is “at least 15%”, but it is likely going to take many more months of negotiation and discussion before the final rate is agreed.

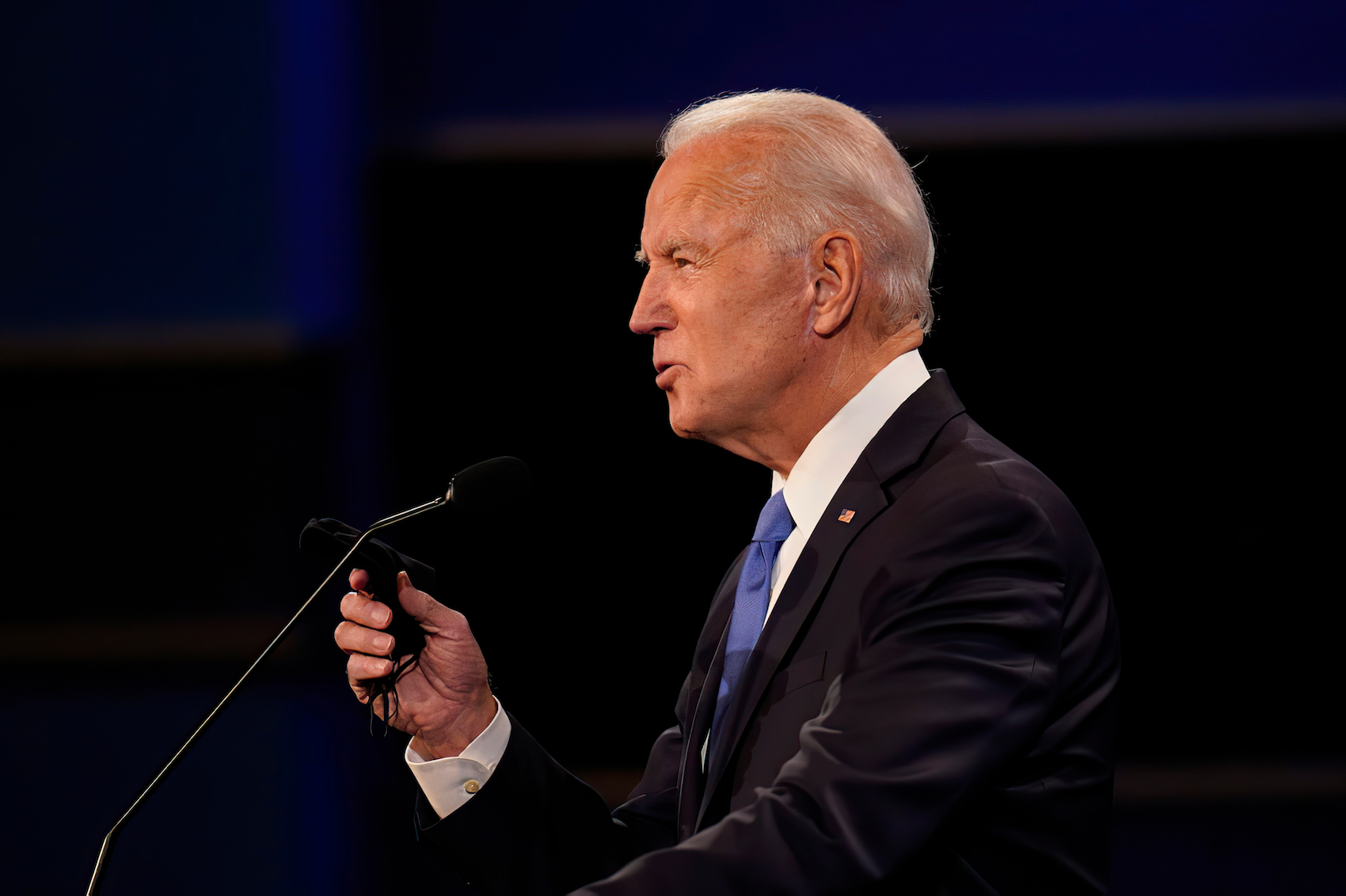

Jersey’s agreement comes despite the island’s Chief Minister suggesting US President Joe Biden – who has largely driven the global reforms – should look “closer to home” before demanding tax changes that could affect the island.

Pictured: Earlier this year, the Chief Minister Senator John Le Fondré suggested the US President Joe Biden ought to look “closer to home” and consider the practices perpetuated by his tax-friendly home state of Delaware.

Jurisdictions that have not signed the deal include Ireland, Hungary, Estonia, Barbados, Kenya, Nigeria, Sri Lanka and St. Vincent & the Grenadines. Peru has not signed because it does not have a government at present.

In recent years, Jersey has been keen to stress its compliance with global tax standards after revelations tarring it with the 'tax haven' brush.

It was reported in 2017 that tech giant Apple moved its offshore funds to the Channel Islands after a crackdown on tax laws in Ireland.

According to the Paradise Papers leak, the company allegedly moved the firm holding most of its untaxed overseas cash to Jersey, after changes were made to controversial Irish tax practices.

The Guardian reported yesterday that "sources close to the [OECD Inclusive Framework] process said it was clear to [low-tax jurisdictions] that the 'writing was on the wall'."

External Relations and Financial Minister Senator Ian Gorst said: “The Government of Jersey has always maintained that international tax standards should be developed on a global basis by organisations such as the OECD, rather than on a regional basis, as this helps protect the principle of maintaining a level playing field among tax jurisdictions globally. This is critical to ensuring that the interests of small countries are balanced with those of larger countries.

“Jersey’s corporate tax system has been carefully designed to meet the island’s ongoing fiscal needs and to align with international standards. This means that Jersey’s corporate tax system is designed to support the requirements of a geographically small economy that is open and attractive to global investment.

Pictured: “Jersey’s corporate tax system has been carefully designed to meet the Island’s ongoing fiscal needs and to align with international standards," Senator Gorst said.

“Jersey is well placed to continue to adapt to international tax standards, and we will continue to engage in a proactive way with the OECD, EU and global bodies to combat aggressive tax avoidance and profit shifting. Our focus continues to be on adding value to the global economy by offering a stable, certain and attractive environment for supporting the growth of cross-border investment in a well-regulated and transparent manner.”

The “historic” tax pact, follows last month’s historic agreement between the G7, has been adopted by all members of the G20 group. Meanwhile, Barbados, Estonia, Hungary, Kenya, Nigeria, Sri Lanka and St Vincent & the Grenadines have not yet sighed, while Peru abstained as it does not currently have a government.

OECD Secretary-General Mathias Cormann said the “historic package” would ensure “large multinational companies pay their fair share of tax everywhere after “years of intense work and negotiations”.

He said the agreement didn’t “eliminate tax competition”, but would set “limitations on it” in a way that accommodated all interests “across the negotiating table, including those of small economies and developing jurisdictions.”

The US Treasury Secretary, Janet Yellen, took to Twitter to explain the importance of the agreement in a thread in which she described the day as “historic” for economic diplomacy.

Who could lower their corporate rate further & faster?

— Secretary Janet Yellen (@SecYellen) July 1, 2021

No nation has won this race. Lower tax rates have not only failed to attract new business, they've also deprived countries of funding for important investments like infrastructure, education, & efforts to combat the pandemic.

“For decades, the United States has participated in a self-defeating international tax competition, lowering our corporate tax rates only to watch other nations lower theirs in response," she explained.

"The result was a global race to the bottom: Who could lower their corporate rate further and faster? No nation has won this race. Lower tax rates have not only failed to attract new business, they've also deprived countries of funding for important investments like infrastructure, education, & efforts to combat the pandemic.”

She said the agreement would ensure that US corporations “shoulder a fair share” of the burden and enable America to enter a “competition that we can win “one judged on the skill of our workers & the strength of our infrastructure. We have a chance now to build a global and domestic tax system that lets American workers & businesses compete and win in the world economy.”

The agreement from the OECD Inclusive Framework meeting will be sent for political endorsement to the G20 meeting of Finance Ministers in Venice next week.

Express has asked the Government to clarify some of the practical implications of the agreement for Jersey, and is awaiting a reply.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.