The rising cost of housing could drag Jersey’s economy down and must be dealt with as a priority, the Government’s influential economic advisers have said.

In its latest assessment, which will have a significant bearing on the next Government Plan and other areas of spending, the Fiscal Policy Panel (FPP) highlights the risks of a widening “deposit gap” for islanders, particularly for lower earning households.

This gap is, in essence, a measure of housing affordability.

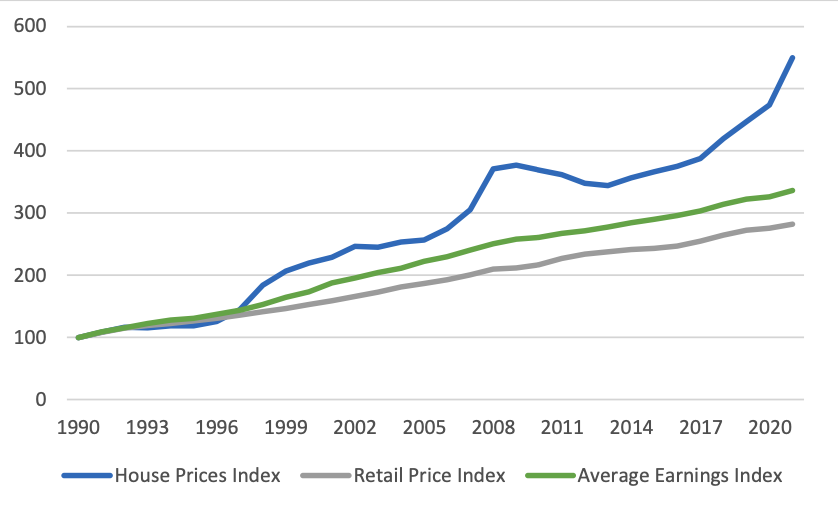

In its latest recently published assessment, the FPP say: “House price growth, as in many other countries, has far exceeded both RPI [cost of living] and Average Earnings growth since the late 1990s.

“A number of factors have contributed to this including limited land availability, depressed interest rates, a relatively high return on property assets for investors and competition for a limited number of properties.”

It adds: “Statistics Jersey produce a detailed housing report annual, including affordability indices and an estimate of the ‘deposit gap’.

Pictured: House Prices compared with Retail Prices and Average Earnings Indices (index 1990 = 100).

“The ‘deposit gap’ represents the difference by which the median [midpoint average] dwelling price exceeds the affordability threshold, expressed as a factor of mean net household income (£60,100).

“In 2021, the deposit gap for a two, three or four-bedroom houses was 1.5, 4.4 and 10.6 respectively."

From that, the FPP conclude that without a deposit which greatly exceeds the standard 10% of property value, a household with median income – £60,100 after tax – will be unable to affordably service a mortgage on a two-bedroom house.

It finds: “In comparison to the UK, the average house price in Jersey was over £150k more than in London.

“However, due to higher median earnings in the Island, the ratio of median property prices to median earnings is lower in Jersey than in London, although above-trend house price rises in Jersey in 2021 have brought the ratio very close to the most recent data available for London.

“The average gross annual salary in a lower earnings sector such as hospitality or retail is around £26,000-£30,000, which is less than half of the net household income used to calculate the deposit gap.

“The affordability estimate is much worse for those below the median household income.”

Pictured: The ratio of median property prices to median earnings in Jersey is now very close to London’s.

The FPP say that making use of some of the 4,000 vacant properties identified in the 2021 Census should be a priority.

“The proportion of vacant properties in the Island rose from 7% of private dwellings in 2011 to 8.3% in 2021.

“Compared to England, this is three times greater than the vacant dwelling rate of 2.6% in 2021."

However, it adds: “These are not direct comparisons as the ONS measure of vacant dwellings is compiled from multiple data sources whilst the Jersey Census shows only a snapshot on Census Day."

The FPP also notes that: “The success of the financial sector is adding cost pressures for other sectors of the economy, this could be contributing to the accelerated growth in house prices.

“This evidence suggests that there is some unused capacity in the current housing stock while housing unaffordability and lack of affordable rent supply poses a risk to economic growth.

“There is a risk of reduced migration of skilled workers as the lack of affordable housing makes the islands less attractive to potential immigrants.

“This should be addressed as a priority.”

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.