Treasury is considering extending a multi-million scheme aimed at keeping islanders employed throughout the virus crisis by helping to pay their wages until October, Express has learned.

The co-funded payroll scheme - which sees the government pay 80% of an employee's wages, up to £1,600 per month - is currently due to expire at the end of June.

However, the Treasury team are now considering whether to extend it for a further three months to provide extra support for industries struggling in the aftermath of lockdown, with a decision due to be made in the next fortnight.

It follows a similar move by the Chancellor Rishi Sunak, who announced on 12 May that the UK Government’s furlough scheme would be extended until October.

1/ The job retention scheme will be extended, for four months, until the end of October.

— Rishi Sunak (@RishiSunak) May 12, 2020

By that point, we will have provided eight months of support to British people and businesses. Until the end of July, there will be no changes to the scheme whatsoever. pic.twitter.com/gQznY4c2Ir

When Express asked at the time if the government would do the same, a spokesperson said the Economic Development Minister was keeping the payroll scheme "under review".

But Treasury Minister Deputy Susie Pinel has now confirmed to Express that she is looking at a similar timeframe, as she explained what options to help the island’s economic recovery are being examined in the wake of a new report showing that the public purse is heading for a multi-million-pound loss and will suffer long-term effects arising from the covid-19 pandemic.

The report suggested that Jersey's major non-finance sectors - retail, hospitality and tourism - will face particular challenges, with the former's corporate tax takings dropping by as much as 50% due to increasing numbers of customers heading online amid store closures.

When asked about what she will do to support these areas of the economy, the Minister suggested that the Payroll Co-Funding Scheme could continue beyond the end of June, when this phase is due to finish.

Recapping her preferred options for reviving the pandemic-hit economy, the Minister commented: “I have said publicly that I personally would not entertain increasing income tax for many reasons, largely the competition side of things, but there is there is, of course, GST; the contributions to Social Security; the caps therein in Social Security which could be either raised or removed altogether.”

Turning to the extension of two Government business support schemes, Deputy Pinel continued: “We've already... deferred GST and Social Security contributions as an option for businesses until the end of June and could look at extending that for the next quarter. We’ve also introduced the payroll scheme, again until the end of June; that could be extended for another quarter. So, it’s all those things that we're looking at... we'll be putting that together over the next couple of weeks.”

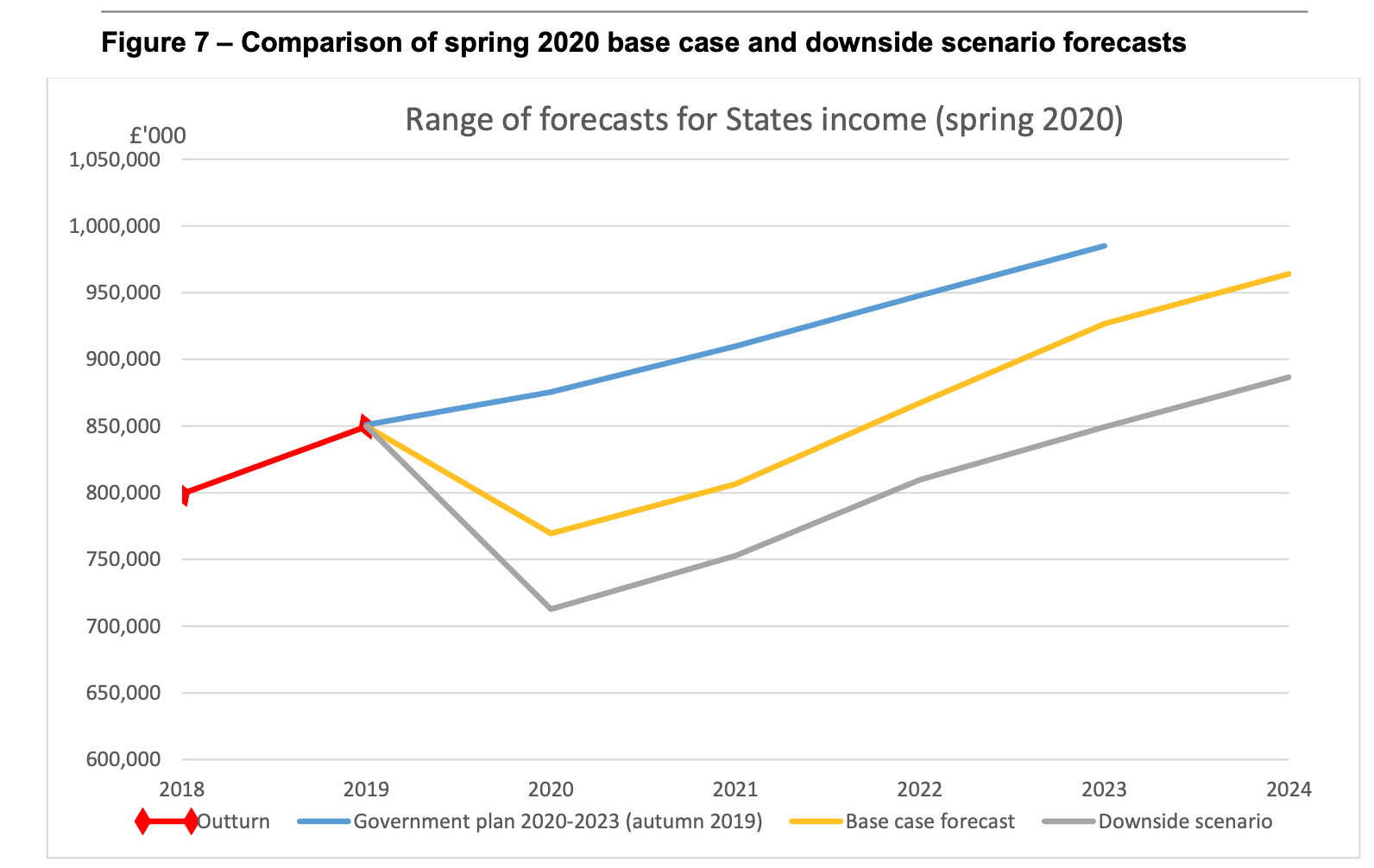

Pictured: The forecasts in comparison to where the Government Plan had placed public finances over the next few years. (IFG/Government of Jersey)

It’s also possible that what Assistant Treasury Minister Senator Ian Gorst referred to as a “super-duper overdraft” – the £500million borrowing facility Deputy Pinel recently signed off on – could have a part to play in the extension of the scheme.

Although it hasn’t yet been decided what, if anything, this facility will be used for, the Treasury Minister suggested that it could provide some flexibility if Government choose to extend the payroll support.

She told Express: “...The payroll scheme to the end of June – so that’s three months – was forecast to be about £138million. Now, if we extend that until the end of October, so for another quarter, that potentially could be exactly the same, or it could be less.

"We don't know how many businesses will need to apply for it for the second quarter; how many haven't applied for the first quarter and might apply for the second quarter."

When asked about the timeframe for introducing Jersey’s economic recovery plan, Deputy Pinel replied: “We will have to come up with immediate decisions on what to do to aid the recovery, be it by extending the payroll scheme or extending the deferment of GST and contributions, or looking at other measures that we can bring into to help. So, that is something that we're doing now and that will be published, as I say, in two weeks’ time.”

Looking further ahead, the Minister explained that the “next stage” of the planned recovery is focusing on how to reboot the tourism industry, by removing the need for visitors to the island to self-isolate on arrival.

Pictured: Assistant Treasury Minister Senator Ian Gorst and Treasury Minister Deputy Susie Pinel.

“The next stage, which we’re also discussing at the moment, is how and when we open up the borders and, again, that of course will depend on other jurisdictions, not just us.”

She explained that part of this would be creating a reopening plan “without having to have people compulsorily quarantined when they get here which is the case at the moment. Obviously, we’re not going to attract tourism if people have to be quarantined in the hotel room for two weeks!”

Referring to one of the options, the Minister said that testing for the virus both on departure and arrival is being considered.

The IFG’s report highlighted that the retail industry might be particularly affected by the way lockdown has accelerated consumer’s migration to online shopping. When asked if she would review retail tax to give businesses more leeway going forward, Deputy Pinel said: “Retail tax is under constant review and, nothing to do with the current situation, it has been for a long time because of... the move to online shopping which has been prevalent very much so over the past few years and, of course, this has highlighted it hugely.

Pictured: The Treasury Minister admits that this crisis has highlighted the threat posed by online shopping.

“The situation in St. Helier and other shopping areas and in Jersey is dire so obviously we are very concerned about that. Looking into the future, as I've already said, we could extend the payroll scheme to help businesses get back on their feet and/or maybe a change in GST, but as I say, all these things have to be looked back together it won’t be one single item going forward it will be a combination of several.”

When asked if seeing the IFG’s forecasts has changed her mind about increasing income tax, the Minister replied: “Well, of course, we have to look at everything of course, but it’s a personal statement that I've made that I personally do not wish to increase income tax. I think we can manage it in other ways, but there will be a considerable deficit it’s already quite clear from the report that we're not going to make a complete recovery until 2024 if then.”

Addressing a question about whether her dismissing a raft of economic stimulus measures announced by her second-in-command as his "personal view" meant the “bold package" of measures wasn’t being considered by Treasury, Deputy Pinel denied this.

“Oh no, they are, absolutely... We're looking at absolutely everything that we can to find a package that combines what is going to help people keep or have money in their pockets.”

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.