Scores of local businesses are making a plea to Government to take responsibility for the financial damage that shutting them down has caused - and warning that they may not be able to get back on their feet again, if they continue to be strangled by stringent support scheme criteria.

Several have voiced specific concerns about the Fixed Costs Support Scheme (FCSS) launched this week, saying it shouldn’t be based on Rates, or means-tested, and asked the Government to take responsibility for the businesses it has forced to close.

The Fixed Costs Support Scheme (FCSS) makes a financial contribution towards a business's fixed costs where they have been impacted by covid-19 related public health measures, including two-metre physical distancing.

The scheme will run until April 2021 and businesses can now apply for their costs from January 2021. It comes in addition to the successful co-funded payroll scheme, and the Visitor Attractions and Events Scheme, which Express revealed today has only helped two businesses in the sector.

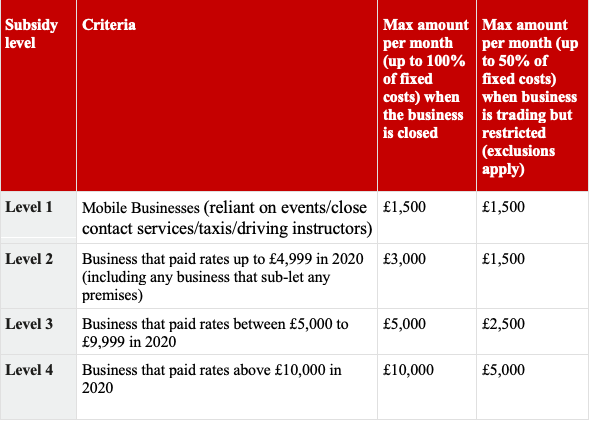

Pictured: The support provided is based on the rates businesses paid in 2020.

The FCSS is open to a variety of businesses including non-essential shops, hospitality businesses, food and drink wholesalers, visitor attractions, wellbeing and beauty businesses, gyms, nightclubs as well as event businesses and venues.

To apply, businesses will have to declare they suffered a material detriment of at least 20% and the amount they can claim is determined by the Parish Rates they paid on their premises in 2020.

Businesses with rates of up to £4,999 will be able to claim a maximum of £3,000 per month they were closed and up to £1,500 if they were trading but restricted.

Some business owners have pointed out how confusing the scheme sounds, with others adding it is not equitable.

Natalie Duffy, the owner of the Salty Dog in St. Aubin, said “one shoe does not fit all."

Pictured: Under the scheme, small cafés and large restaurants could claim the same amount of money.

She explained that the system would mean that everyone would fall “into the same bracket”, with small cafés being able to claim as much money as larger establishments with 40 seats and four times their income.

“It could have been based on the rent, which is more realistic in respect of the value or it could have been based on the number of covers because that is covered legally as far the government is concerned,” she said.

“The point is what they are offering us is less than 10% of my fixed cost, it falls short of what we need.

“The people who are managing this do not appreciate the value of the industry to island life, they will soon see when they do not reopen that island will become a boring and dull place to live without restaurants and cafés.

“The problem is we have through the Jersey Hospitality Association provided the details of our finances and the devastation that we have been experiencing and it hasn’t been listened to, it has been pushed aside for a scheme by people who are not commercially-minded, who are not at risk and who do not understand the situation we are in.”

Pictured: The scheme is open from January to April, even though nightclubs and event businesses have been closed since March 2020.

Ms Duffy said that colleagues in the industry had expressed “enormous disappointment that the value of hospitality clearly is not recognised because of the way we are being treated”.

“They told us to shut, well look after us and make sure we can stay open,” she said.

Her concerns were echoed by Rojo's owner J-P Anquetil.

“It just means that all businesses no matter how much they are paying are going to be able to claim for the same amount,” he said. “I do not understand why they have done that. It should not matter what the business pays, sometimes they do not pay.”

Some businesses have expressed confusion at the fact the scheme didn’t include December - normally one of the most profitable points in the year. JP also noted that it does not go back to last March either when most nightclubs and the event industry were shut down.

“They just want to do the bare minimum for businesses to survive,” he said. “A lot of business are in so much debt, it’s going to be an uphill battle.

“As much as any support is welcome, they have not been good at targeting it for those who really need it.”

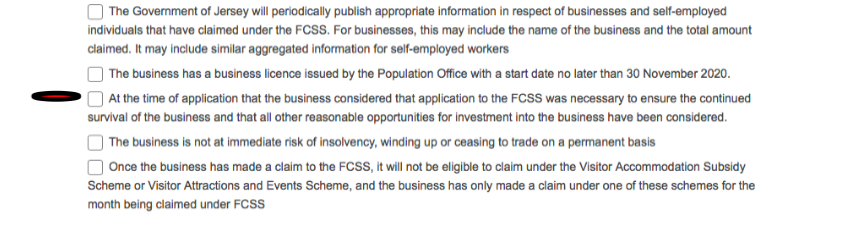

Pictured: Businesses have to confirm they have considered “all other reasonable opportunities for investment into the business”.

For Andrew Hosegood, owner of El Tico, the scheme is “over-complicated”.

“The best way of doing it was to cancel the employer’s social security contributions because that is in direct relation to the size of the business.

“You could be a small café in town, and you would be paying £600 in rates and you can claim £3,000. Where is the equity in that? It’s not properly thought through, it has no relevance to commercial reality.”

Concerns have also been raised about the declaration included in the application form for the scheme.

Businesses are being asked to confirm that, at the time of applying, they considered it was necessary to do so “to ensure the continued survival of the business” and that they had considered “all other reasonable opportunities for investment into the business”.

“The Government instructed us to close, and should therefore take responsibility,” Mr Hosegood said. “The level of support should not be means tested, but available to all affected businesses.”

In a statement signed off by the Economic Development Minister, a Government spokesperson responded: "The Fixed Costs Support Scheme provides financial support to businesses impacted by recent Government measures which have forced them to close as a result of the covid-19 pandemic. To claim under the scheme applicants need to show that they have suffered a 20% fall in turnover when compared with a comparable month in 2019.

"Before applying a business is required to confirm that the support is necessary. This does not require businesses to have exhausted alternative funding options, or to have explored any particular approach.

"Where businesses need to claim under the Fixed Costs Support Scheme they are strongly encouraged to do so. At 9am on Thursday 11 February over 100 businesses had applied for support under the Scheme."

An official review of whether the Government's support measures have been successful in helping businesses was launched last week by the Economic Affairs Scrutiny Panel.

It will seek to identify:

The Panel’s Chair, Deputy David Johnson, said: “We are following up on our previous review of the covid-19 response by focusing on the support packages made available to businesses. We have chosen to focus on the experiences of self-employed people because we know that many have experienced particular business problems during the crisis and have expressed concerns to us and in the media about accessing support from the government.”

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.