It doesn’t take long in any conversation with someone in Jersey’s financial services industry before they mention, “the Commission".

Now, it goes with the territory of being a regulator, that opinions aren’t always favourable; in fact, as you’ll read in the following article, measures which don’t seem to please anyone are often the right ones (from a regulatory perspective) to be taking.

But, it would be rare to find someone who sensibly argues that the JFSC is wholly unnecessary – so, that places the debate firmly in the territory of exactly what, and how, it should be going about its business.

A key figure in that is Mike Jones, the Commission’s Director of Policy and Risk. His work combines representing Jersey internationally (in the sense of implementing international standards) applying Jersey’s own legislation, guidance and codes of practice, and working on FinTech innovation.

Pictured: Mike Jones is the Commission’s Director of Policy and Risk.

Against a global backdrop of increasing uncertainty, he spoke to Express about how the Commission planned to tackle some of the major issues facing the island’s key sector...

Mike Jones: This year, for the Commission as a whole, the big things are preparing for the next FATF-style assessment, which is a Council of Europe body called Moneyval. We don't know precisely when they're coming in, but we know it's in the next few years. We have to do something called a national risk assessment, which is a jurisdiction-wide piece of work and then we look at our regime and how effective we are at implementing against that.

Then there's the registry workstream, the other big piece of work, so that is ensuring that our registry meets the international obligations that our government has signed up to. That might be with the UK government on things like beneficial ownership registers and transferring information or that might be internationally, so things like EU directives and so forth.

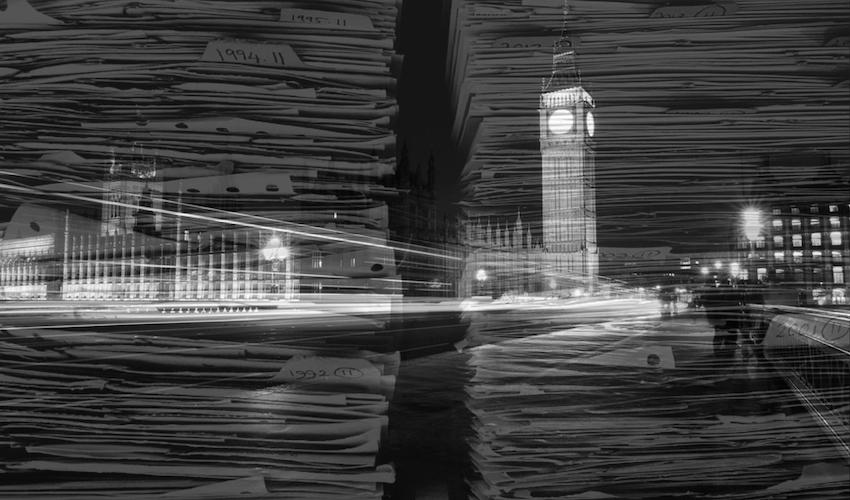

Pictured: Brexit is on everyone's minds at the Commission.

MJ: So, I'd say the vast majority of our time at the moment is working with government on preparing, but at the moment all eventualities are still in play.

So, at the moment, what we're doing is making sure the industry is ready no matter what the scenario, so there's a lot of engagement with those industry bodies, with the big banks that might be affected the most. There's a lot of scenario planning and testing, 'what if there's a devaluation in sterling? What if there's a run on the pound?' testing those sorts of things to ensure that our banks are in a satisfactory position, irrespective of the outcome.

The other thing that we do quite a lot is liaising with other regulators, liaising with UK authorities. We've recently signed a new MOU with the FCA, it's quite complicated, but to ensure that our funds management industry carries on irrespective of the outcome of Brexit, so that the funds industry can market into the UK and vice versa.

The rest of it is managing expectations with industry, so saying, 'Brexit is just a risk like any other risk that you're dealing with. We expect you to have analysed it appropriately and put in place procedures and plans to deal with that risk.' So, a lot of it is doing the basics, really, with industry.

Pictured: Westminster has been calling for the true owners of companies based in Jersey to be published.

MJ: It's very difficult to tell, as are all of these things. So, we firmly believe that our system, which is a register that we hold, that we can share with appropriate authorities and that is verified and there's a regulated entity in the process, works incredibly well. Compare it to an international standard, compare it to any other jurisdiction, UK, wherever.

So, we know that system works, but different jurisdictions have different issues. So, we are a, you know, reasonably small jurisdiction, we can implement trust company business regulation relatively easily, perhaps that's quite hard for the UK to do. So, we know our system works for Jersey, perhaps something different works better for the UK.

What we've always said and Jersey's position on beneficial ownership and Jersey's position on any issue is that, if there's an international standard and a level playing field, we'll meet those requirements and we always will.

Pictured: "It's unfair to expect, sort of, little old Jersey to move ahead of major EU beasts and so forth."

We've got a track record of doing that, whatever the issue may be. So, that's a long-term strategy for Jersey, compete on quality, meet the international standards, but there's got to be a fairness point as well. It's unfair to expect, sort of, little old Jersey to move ahead of major EU beasts and so forth.

So, our position is we think our system works well, we'll monitor what the international standards might be, we'll monitor if there are regional standards, i.e. EU standards, we'll monitor what the UK does, we'll engage with a sensible dialogue with all those parties.

We have the same interests as all those parties in that we have no interest in there being any money laundering or financing of terrorism from our jurisdiction, we just happen to think our system is probably slightly better at defending it than perhaps where people want us to move to.

Of course, there's a huge amount of work to move in that direction as well, so when there's a lot else going on, it seems unfair to rewrite the system that works quite well, but we will have to see.

Pictured: "With Donald Trump making waves against the international standard setters, it might actually not get any better any time soon."

MJ: That's a very good question. I genuinely don't know. You'd like to think that it might calm down, but if you think of the, sort of, geopolitical environment that we're in with Donald Trump making waves against the international standard setters, it might actually not get any better any time soon.

It's fairly destabilised in terms of the US is increasingly isolated, the UK is suddenly a little bit more isolated from the EU. So, had the world continued with international standard setters setting the rules and everyone gradually meets them, I think then it may have ended, but where we are today, with Brexit and with the US position on global politics, I'd say there's a chance that this is the new norm, actually, and that we will always be, not fighting a war somewhere, but we'll always be struggling to satisfy someone of our position.

What we've always found works quite well is if you do the job well and you do what's appropriate internationally, then you've actually got a defendable position and you're not, sort of, ducking and weaving from one person to the next and you've told, you know, the UK one thing and the US another thing and the international standard setters something else.

As long as you're doing the right thing, then it's a consistent story and that is what we've always done in Jersey in terms of, 'what are the standards internationally?' We will work our way towards them and, often, we'll be there ahead of most major nations as well. That's something our industry sometimes gets a little bit upset about, but I think it's the nature of the world that we live in as an offshore centre, sometimes you need to be whiter than white, just to be perceived as grey.

Pictured: Martin Moloney began his five-year term at the Jersey Financial Services Commission (JFSC) on 28 February 2019.

MJ: I don't think there'll be any dramatic change in direction. I mean, the circumstances when Martin (Moloney) joined us are the same as the ones when John (Harris) left. There's Brexit, there are the challenges from international standard setting bodies, there's the industry that we currently have, the ones that are growing, perhaps the ones that are seeing less growth. I mean, he's only been in place a couple of months, really.

I think, initially, what we're seeing is he's doing the right things in terms of speaking to as many people as possible, he's getting lots of opinions, he's analysing the situation that he sees. I think, inevitably, there may be some tweaks that he might want to do in terms of policy. He's come from a large EU regulator, the Central Bank of Ireland, so he's familiar with how that world works.

He's a real regulator, he understands the policy work inside out, actually, so we've found that we're taking policy matters to him, and he's really giving us a grilling and I think that's really healthy in terms of his understanding of the issues. I think, for him, it'll be building relationships with the key stakeholders in the island over the first six months or so, analysing the structure that he's got.

The business plan was in place when Martin joined, so I don't think you'll see any dramatic changes to that, but clearly, you're already in the next cycle of the next business plan. Actually, we tend to start work on our business plan in the summer, we're coming up to that already, so I think what you will probably see is, the next iteration, the next business plan, which might be a three-year business plan, for example, perhaps a slight tweak and change of direction, but I don't think there'll be anything dramatic.

Pictured: Technology will only speed up in the future.

MJ: I think we're doing a huge amount in that space and we certainly have done a lot over the last three or four years. I can see that only speeding up, though, we're going to have to do more and more. We've had a huge investment in our Change Programme at the Commission over the last three or four years, to be able to digitally interact with industry and you need that.

The volumes of data we deal with these days, you can't do it any other way. So, I think we'll probably see more in that space, rather than less. That will cause issues in terms of how you fund that, so that's protecting that data as well as how you collect it, store it, sort it and so forth, but what we're seeing is more and more online interaction.

So, last year, we rolled out this Jersey Private Fund. I think we'll replicate that for other products, we might replicate that for service types as well. We'll see more API interfaces with industry, so their computers talking directly to our computers, populating our databases so that our resources are verifying that data, rather than keying it in, I think we're going to see more and more of that. Then there's a comms angle to it as well, so there'll be a new website launch from us, so that people can see a clean, fresh interface with us and I think that sends out the right signals as well, but there's only going to be more in that space for us.

Pictured: Success in policies is about balance.

MJ: It's about getting the balance right. So, I often joke that if we do something and nobody likes it, then we've probably got it about right. If our commissioners like it too much, then industry won't and if industry like it too much, then we've probably got something wrong or the government doesn't like it, or if one industry likes it over another one, then we've favoured them.

So, if everybody tolerates it and says, “Actually, I understand where they're coming from and it makes sense in terms of the long-term future,” then that's normally the right outcome!

I mean, you can measure it in terms of growth of the industry. So, a big new policy piece of work over the last couple of years is the Jersey Private Fund, and that's had huge success in terms of amalgamating different fund types in a way that we're comfortable, as a regulator, because there are efficient supervisory and authorisation protections in there, but industry have seen a streamlined and simplified product that they can go out and market and that's been going quite well in the UK, Europe and the US.

Interestingly, often, there'll be a new product that industry wants, but perhaps we won't be so engaged in, or a new law that we see hasn't been particularly well taken up on, and yet a new product where we all work together, like the JPF, that's been a rip-roaring success, so you can measure it in different ways.

Pictured: "A regulator's job is to tell people to do things that they don't want to do, sometimes."

MJ: No. I mean, let's be honest, a regulator's job is to tell people to do things that they don't want to do, sometimes. So, they'll never always be aligned on an individual firm basis, but I think when you sometimes step back, and even the same individuals that perhaps you had a disagreement with on something, but they're then representing their sector, you do find that they are aligned, actually. If they're thinking long-term, which we have to think about, which government has to think about, which JFL has to think about, then sometimes you get a different position.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.